DAO Partner Engagement Program

Over the last few months we have been working on the ‘Launch Partners Token Sale’. Today, we are finally ready to roll it out. The Partner Engagement Program proposal is already available in the forum for the community to review and comment on, and it will be submitted to a vote in the coming days. The post below includes a more detailed description of the sale mechanics, motives and expected outcomes.

Funding the DAO

SSV.Network requires extensive resources in order to become a flourishing ecosystem and fund RnD efforts for the coming mainnet. The Launch Partners will transfer ETH, USD, wBTC etc. and receive SSV tokens in return. The more resources in control of the DAO, the better its ability to create the right incentives, bootstrap a community and provide RnD grants for talented developers.

The sale will serve as a catalyst for better token distribution and decentralization. Creating the right partnerships by way of token allopcations will also allow us to onboard experienced, battle tested companies which hold SSV tokens and participate in DAO decisions.

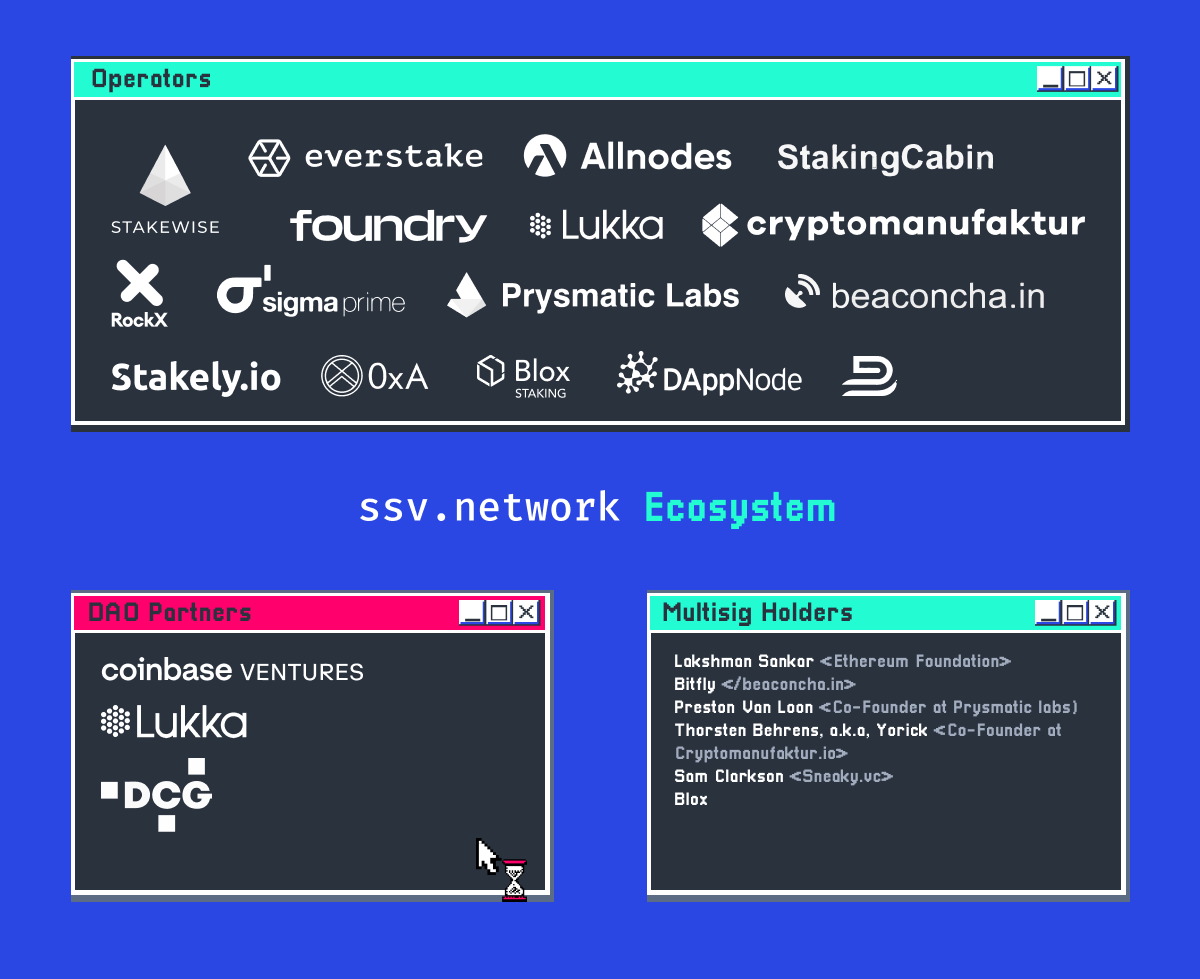

Genesis partners announced!

We are excited to announce the first 3 DAO partners (additional partners will be announced on an on going basis):

- Digital Currency Group

- Coinbase Ventures

- Lukka, Inc

(See partner description below)

Total allocation: 323,102 SSV

The above companies are a perfect fit for the 1st batch; all have extensive experience in running large scale blockchain infrastructure. CoinBase and Foundry(DCG) are also household names in staking. The three companies have been running an SSV node since testnet inception, have a deep understanding of SSV tech and its potential in the ETH staking space.

The above companies are the first participants in batch 1, in the following 2 months we will potentially add more interested parties for the DAO’s review.

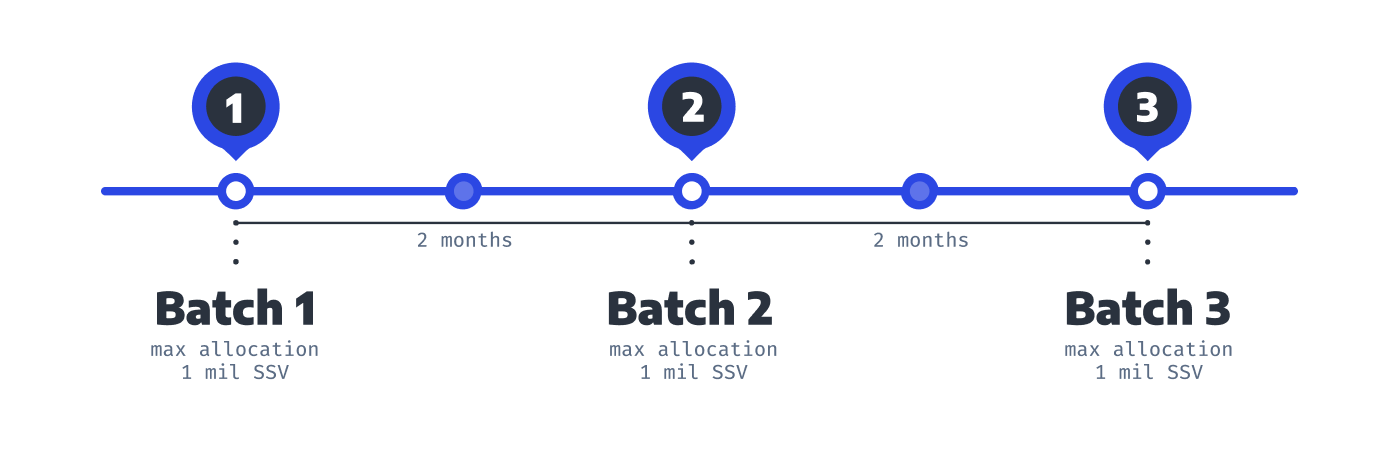

Batch 1,2 and 3

The program will be divided into 3 batches. The 1st batch will start after the DAO vote while the following batches will take place in 2 month intervals. The entire program will spread over a 6 month period.

At the beginning of each batch, a new SSV token reference price will be determined according to the last 30 day average price. For example:

- 30 day average price — 6.19 USD*

- Reference period — 2 months

- Parties who will join the sale up to 2 months from the vote will be able to acquire SSV tokens for the reference price of 6.19 USD

- Any party who wishes to join the sale after the second month will have a new reference price to consider.

*Reminder: the CDT to SSV reverse-split ratio is 1:100. A 6.19 USD/SSV reference price represents 0.0619 USD/CDT, check the real time price here.

SSV supply

The SSV tokens required for the token sale will be minted by the DAO. The minting will be done on a ‘per proposal basis’. We will not propose pre-minting 3 million SSV as originally suggested.

Minting on a per-proposal basis will be helpful in limiting the supply of new SSV tokens to the required minimum. It will also provide the DAO more control over the sale process on an ongoing basis.

Example; according to the previously mentioned reference price of 6.19 USD, the DAO will mint 161,550 SSV tokens for every USD 1 Mil of raised capital.

Minting cap — Unless the DAO votes otherwise, total minted SSV tokens will not exceed 3 Mil. Each batch, 1 Mil SSV tokens will be made available for new partners.

Lockup and vesting — All participants will have 1 year cliff and 1 year linear vesting on their SSV allocation. One of the advantages of a 3 batch structure is that the SSV minted by the DAO will be liquid in stages and not all at once. According to the current structure, all vested SSV will become completely liquid within 2.5 years give or take.

Voting rights for the total amount of minted tokens will be available from day one.

Potential use of proceeds

The DAO will be able to allocate the funds for various initiatives (not limited to):

- Development grants

- Network growth

- DEX liquidity

- Incentivized testnet program (increased rewards for validators and operators)

- Anything else the DAO will deem necessary

Looking ahead

The DAO began its journey by voting in a native token — SSV. The next major milestone is using SSV to ensure the network has all the needed resources to move fast and grow.

We already have 4 ways to interact with the SSV token:

- Launch Partner token sale

- Incentivized Testnet Program

- DAO voting

- On going community engagements (PAOPs etc.)

One of the next meaningful steps involving SSV token is integrating the operator fees token model into the SSV.network ecosystem. We are currently working on the smart contract implementation that will be rolled out on testnet in a few months.

Prior to mainnet launch we will continue to add additional ways to use, earn and interact with SSV. The Launch Partner token sale is one of the first meaningful steps to establish SSV as the driving force behind the ssv.network protocol and DAO.

Make sure to vote and comment in the forum!

Appendix — partner description

- Digital Currency Group — DCG is the most active investor in the digital assets sector, with a mission to accelerate the development of a better financial system through the proliferation of digital assets and blockchain technology.

- Coinbase — Coinbase Ventures — Coinbase is a leading online platform that allows merchants, consumers, and traders to engage with the crypto economy. Coinbase recently went public on the NASDAQ, and is considered by many one of the most successful crypto companies. Coinbase Ventures, the investment arm of Coinbase, has made over 150 investments across the crypto ecosystem, ranging from notable international plays to crypto tax players, to marketplaces, to infrastructure plays, to decentralized finance.

- Lukka, Inc. — Lukka is the leading enterprise crypto asset, middle and back office data and software provider. Lukka solves the very unique complexities of crypto (and blockchain) data for businesses so that they can adopt digital assets. Its customers include Crypto Asset Exchanges and Trading Desks, CPA & Accounting Firms, Funds, Fund administrators, Fund Auditors, and Financial Auditors, Miners, Protocols, individuals and any business that interacts with crypto transactions. All of Lukka’s products are created with institutional standards, such as AICPA Service and Organization Controls (SOC), which focus on data quality, financial calculation accuracy & completeness, and managing technology risk. Lukka is a global company, currently headquartered in New York City.