SSV Staking

2/4/26

Making SSV an ETH Accrual Token

When infrastructure wins, Ethereum wins. This post is about the next step: how the community can win too by participating in the operation and maintenance of crucial SSV infrastructure.

TL;DR

SSV Staking is proposed as part of a broader set of upgrades that optimize the SSV token's utility, moving it beyond a governance token to an ETH accrual token. In practice, this proposal introduces staking and delegation, allowing SSV holders to stake SSV and have ETH-denominated protocol fees redistributed to them via a staking mechanism.

When infrastructure wins, Ethereum wins. This post is about the next step: how the community can win too by participating in the operation and maintenance of crucial SSV infrastructure.

Disclaimer: Everything below is intended to spark discussion, representing a vision for the future of SSV Network, and is subject to approval by the SSV DAO.

ETH is the resource. Validators are the engine. cSSV reroutes protocol fees to stakers.

Validators are rewarded in ETH for their work in administering the Ethereum blockchain. The SSV Network makes that validator layer more resilient and decentralized with Distributed Validator Technology (DVT). SSV staking connects distributed infrastructure to SSV tokenomics.

Today

Validator owners pay operators in SSV

Operators cover operating costs with SSV

Infrastructure adoption and token value are weakly linked

With SSV Staking

Network fees are paid in ETH

ETH-denominated network fee is routed to SSV stakers

SSV becomes a net ETH-accruing infrastructure asset

SSV staking introduces a tokenomic model in which SSV functions as an ETH accrual token, with value derived directly from protocol usage.

SSV Staking Pillars:

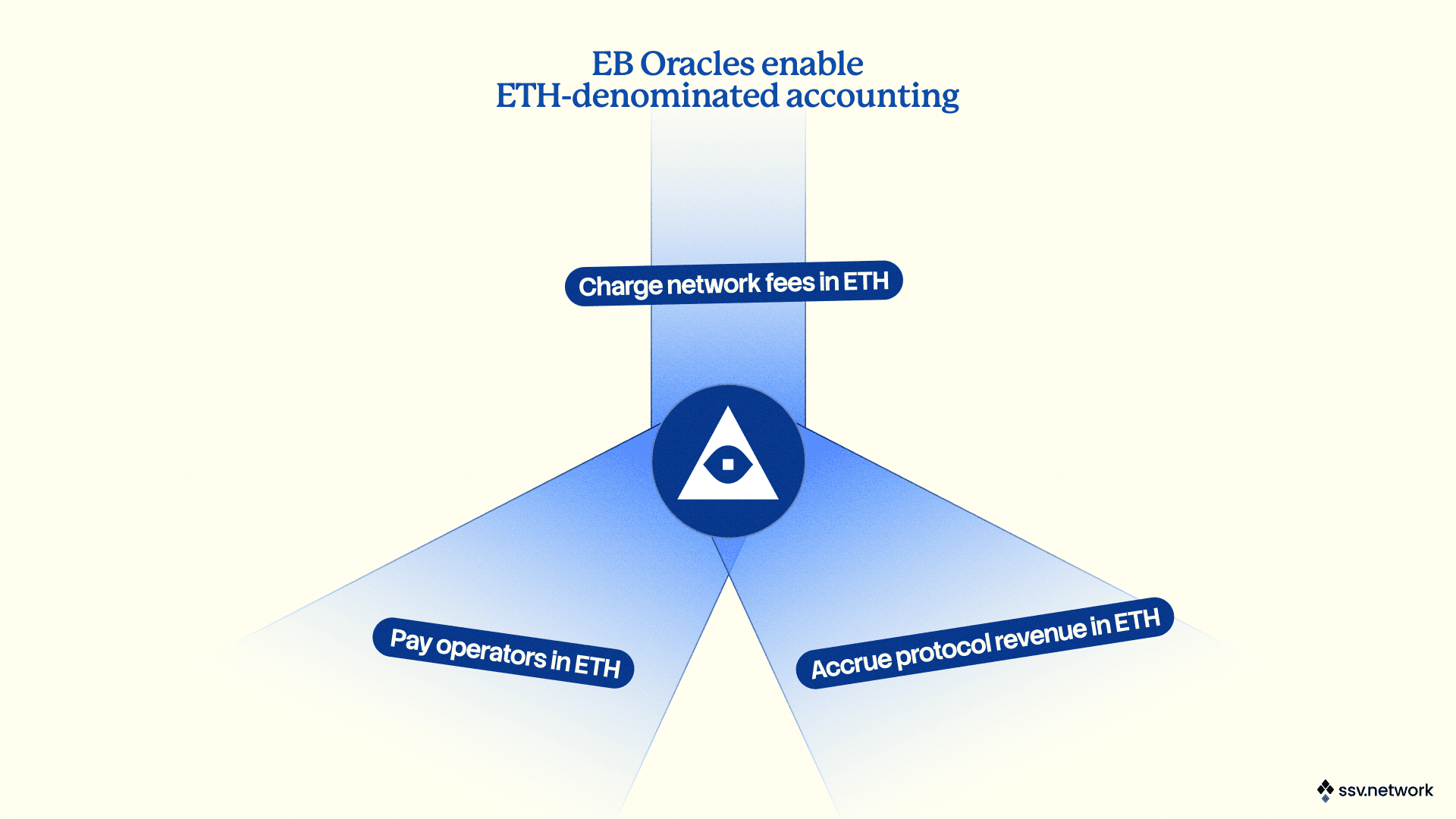

ETH Payments introduces native ETH-denominated fees at the protocol level, allowing network and operator fees to be paid and settled in ETH.

Effective Balance Accounting upgrades the protocol’s accounting model to calculate fees, runway consumption, and liquidation conditions based on validators’ actual effective balance, rather than assuming a fixed 32 ETH per validator. This enables stake-aware accounting that natively aligns the protocol with Ethereum’s post-Pectra validator model.

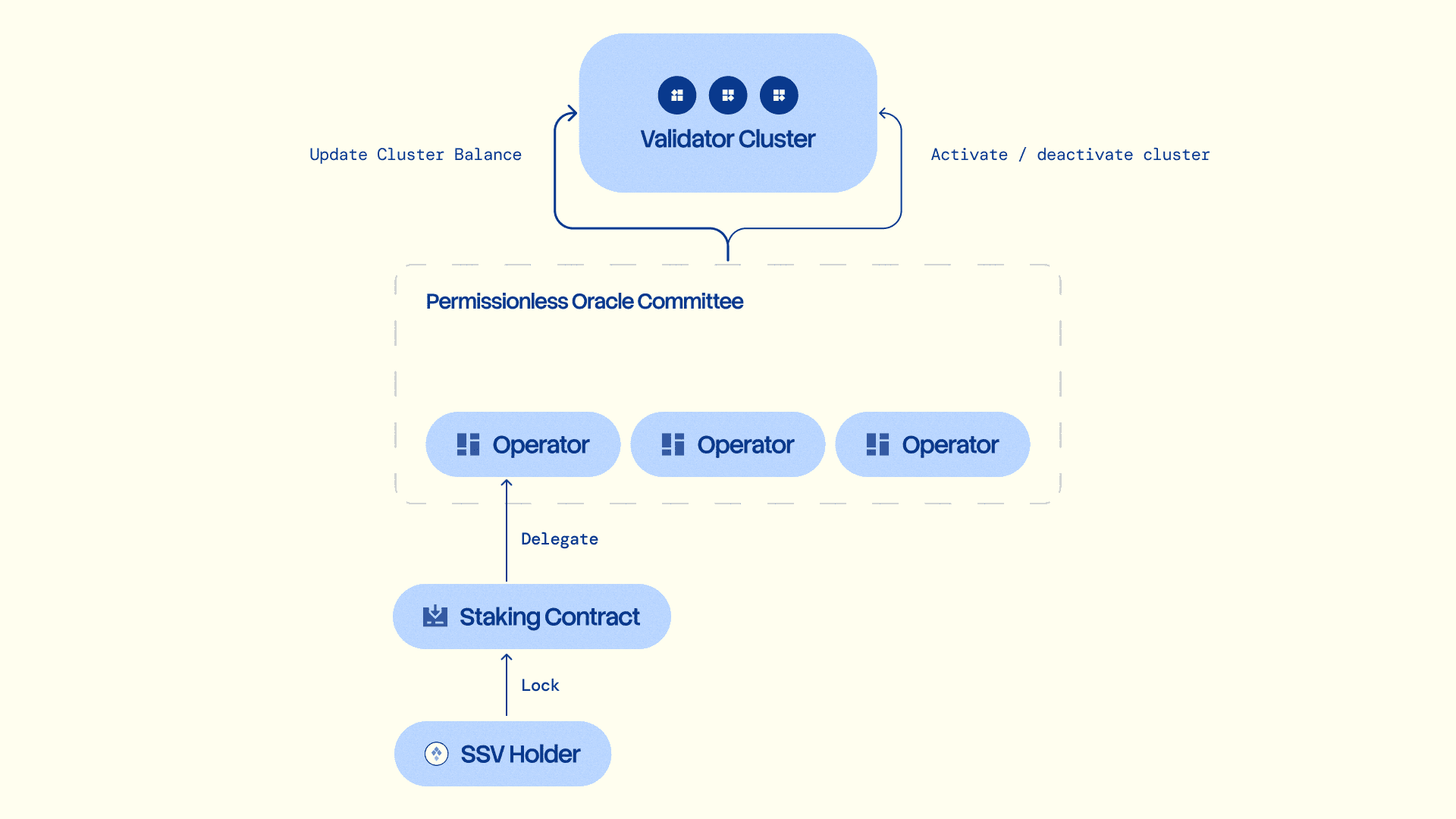

SSV Staking is a way to select the oracle set that reports cluster balances, shortens liquidation collateral requirements, and overall simplifies cluster management for the network. Through staking, participants lock SSV and support the protocol's operation by participating in the distributed selection of Effective Balance Oracles. In turn, they are rewarded in ETH for their effort based on the amount of SSV staked.

ETH Payments: Aligning SSV Network with Ethereum’s Native Resource

Ethereum’s validator economy runs on ETH. Validators earn in ETH, costs are priced in ETH, and operators measure runway in ETH. When a protocol that serves validators settles fees in a different asset, it can create friction.

Moving SSV Network payments to ETH is therefore not cosmetic. It’s a structural alignment.

Just as importantly, it separates two roles that shouldn’t be conflated:

ETH becomes the network’s economic unit for settlement, i.e., how the protocol charges, pays, and accounts for validator operations.

SSV remains the governance and coordination asset—used for staking, delegation, and participating in the protocol’s long-term maintenance and security model.

SSV Staking requires a shift: both operators and the protocol collect fees directly in ETH. Each validator cluster is tagged with an accounting denomination type, either SSV or ETH, and the protocol maintains separate indices for each.

ETH-denominated payments align the protocol’s accounting with the reality of the system it supports: fees settle in the same asset that validators are rewarded in, operator economics are easier to reason about, and the protocol no longer depends on an external price relationship to keep its core fee system stable. Most importantly for SSV Staking, ETH payments make it possible for protocol fee flows to be redirected to participants in native ETH, not through emissions or abstractions, but through usage of critical infrastructure.

Determining ETH-denominated Network and Operator Fees with Effective Balance Oracles

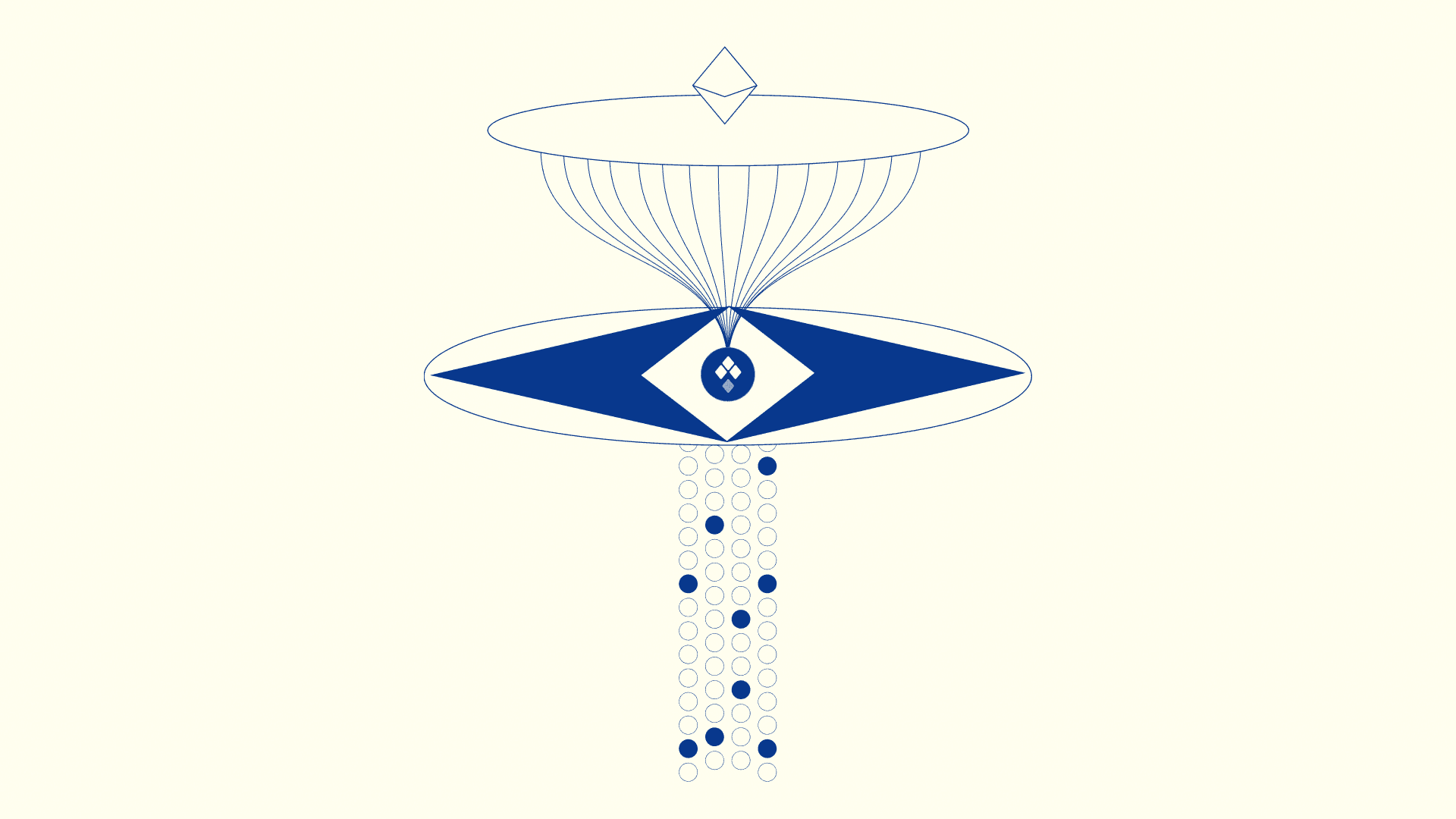

Validators’ effective balances live on the consensus layer. The SSV contracts cannot query the beacon chain directly, so they will need to rely on a dedicated set of Effective Balance (EB) Oracles to bring that data on-chain.

EB Oracles operate as off-chain services, ideally as sidecars to existing SSV nodes (TBD). On a regular schedule, they scan all validators associated with SSV clusters, read their effective balances from the beacon chain, and aggregate the results per cluster. When they detect that a cluster’s total effective balance has changed in accordance with the DAO-set thresholds, they propose an update on-chain.

SSV Staking strengthens the role of SSV holders beyond passive ownership. Through the staking mechanism, participants lock SSV and delegate their stake to a permissioned oracle set (which will become permissionless and decentralized in the future) responsible for maintaining accurate, effective balance accounting within the network.

It’s not: deposit SSV tokens → earn magical yield.

It is: stake → delegate → help secure a core protocol function → rewards in ETH.

Oracles are integral. If effective balances are wrong or unreliable, the protocol’s effective balance accounting becomes unreliable. And if accounting becomes unreliable, fee logic, runway logic, and the system’s ability to operate predictably are undermined.

That is why the staking mechanism is tightly coupled with oracle selection: individuals with long-term exposure to the protocol help shape and secure the oracle system on which the protocol depends.

SSV Staking Strengthens the Community’s Role

Ethereum users already understand the real thesis: Security is a product. Reliability is a product. Decentralization is a product.

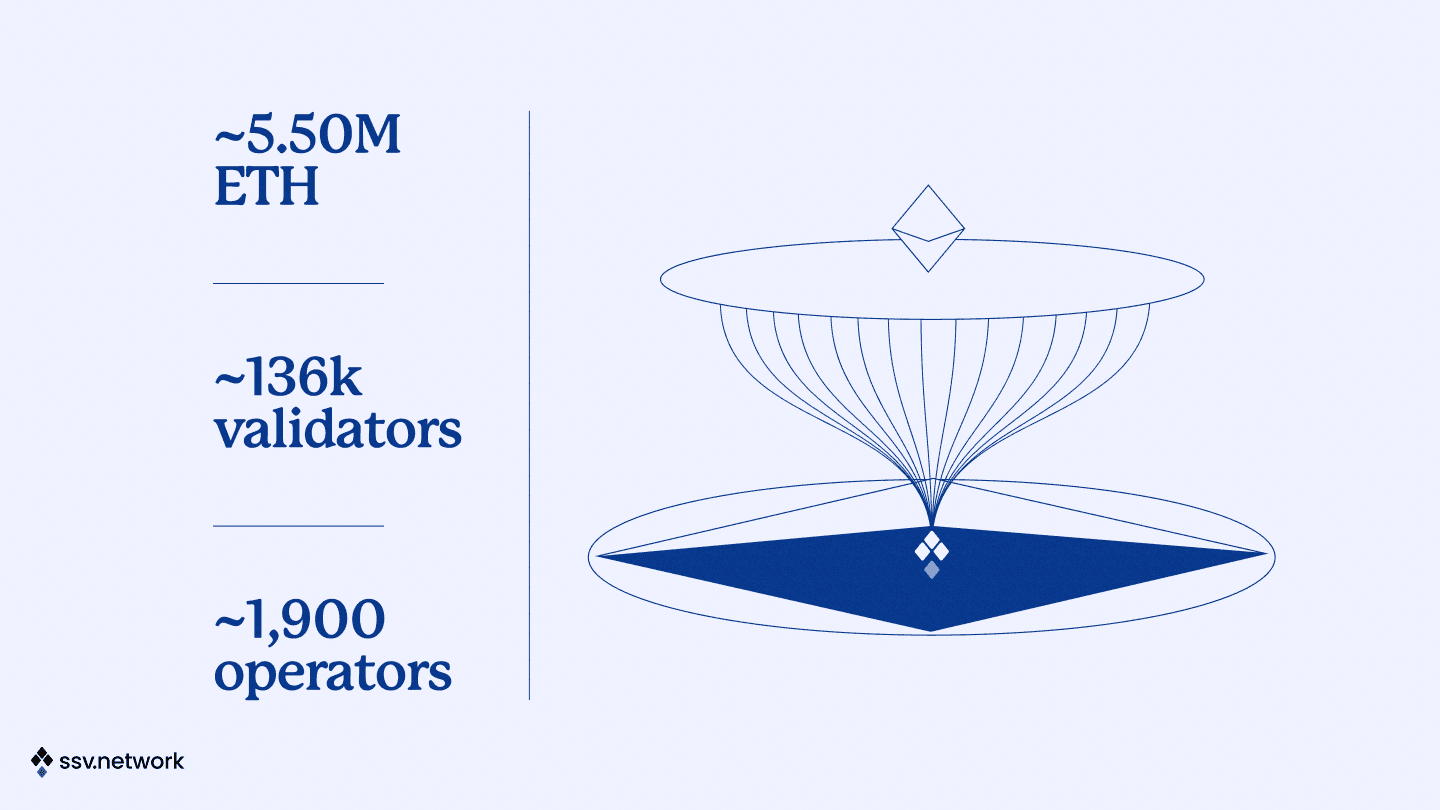

SSV Network isn’t a future bet; it’s already core Ethereum infrastructure. In just over two years, SSV Network has become:

Ethereum’s second-largest staking infrastructure

Securing 5.5M+ ETH

Powered by ~1,900 globally distributed node operators

SSV staking simply turns this existing infrastructure demand into something the community can participate in directly.

SSV Network helps decentralize and harden Ethereum validator operations. SSV Staking extends that mission inward by making the community part of the mechanism that keeps protocol accounting correct as Ethereum’s validator model changes.

The direction is clear:

SSV Staking is a way for SSV holders to participate in operating and securing a core protocol function—and to have protocol fee flows reflected through that mechanism in proportion to their participation.