SSV Staking

2/12/26

Putting SSV Network Fees to Work

SSV Network fees come from Ethereum validators using DVT, and SSV Staking lets participants secure the network while earning a share of those ETH rewards.

SSV Network fees reflect the demand for distributed validator technology (DVT); they’re generated at the exact point where Ethereum’s validator economy pays for decentralized operation. SSV Staking turns that fee flow into ETH rewards for stakers by making them active participants in securing core protocol functions, so SSV stakers backing the network also have a chance to claim a portion of infra rewards.

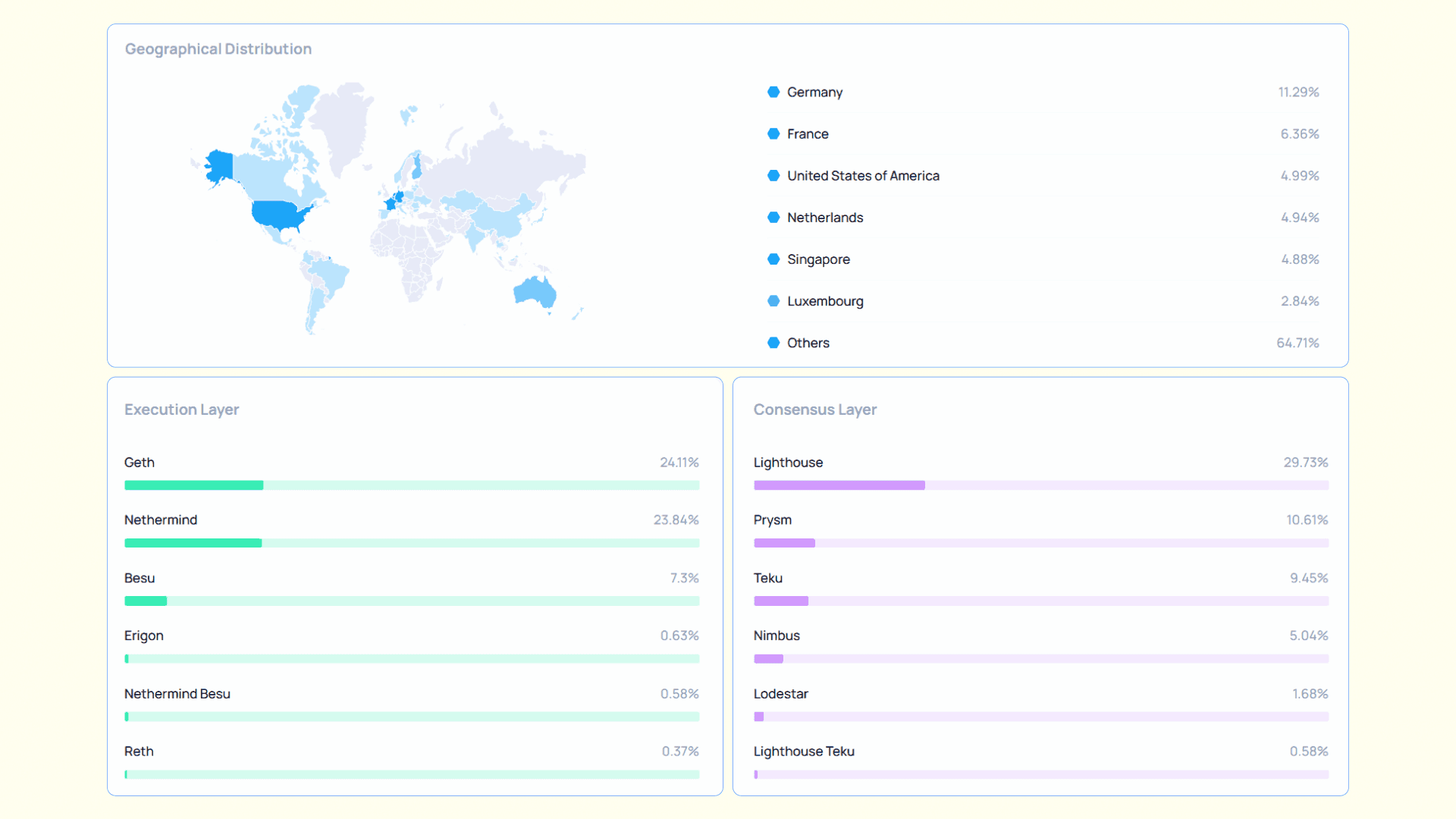

SSV Network is the leading DVT provider on Ethereum, securing ~6M ETH, accounting for ~16% of all ETH staked. This monumental amount of ETH (deposited to approximately 136k registered validators) is run in a decentralized manner by 1900 globally distributed node operators, each using different infrastructure solutions, e.g., cloud and bare-metal. As well as execution, consensus, and validator clients.

Validator owners who register their validators on the SSV Network pay a fee to the node operators that operate their stake. A percentage of that fee is charged by the DAO as a network fee. Historically, those fees were added to the treasury to fund different initiatives for the SSV Ecosystem. Now that the ecosystem has grown extensively and SSV has been integrated into the leading staking protocols, it’s time for SSV holders to participate in securing core protocol functions and be rewarded for it - in ETH.

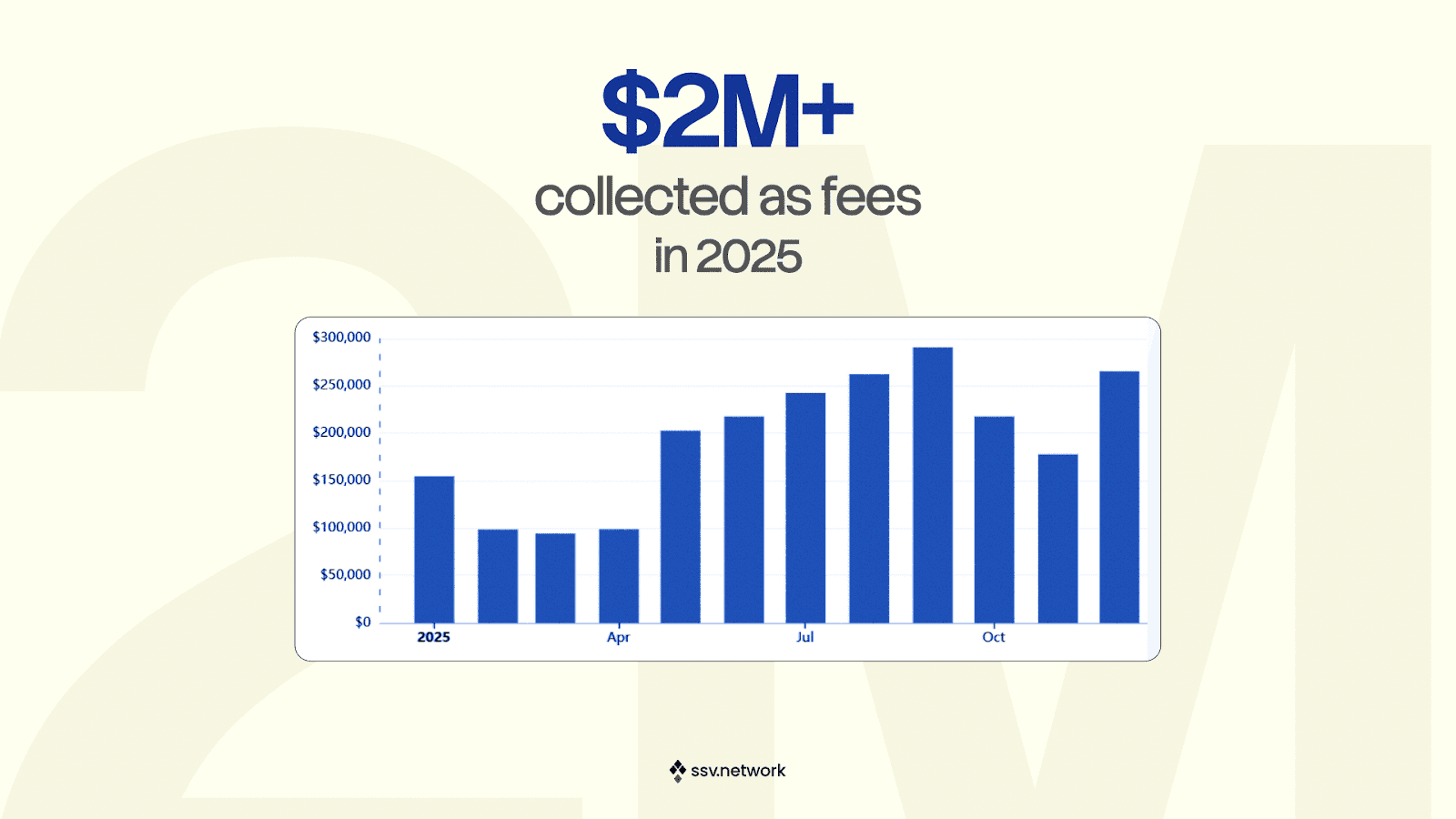

In 2025, the SSV Network generated ~$2M in protocol fees. The proposed SSV staking mechanism aims to reward participants with future network fees who lock SSV and support the protocol’s operation by participating in the distributed selection of Effective Balance Oracles (covered below).

The newly proposed protocol upgrades include SSV staking, which will put network fees to work.

Before SSV Staking | After SSV Staking |

Network & Operator fees charged in SSV | Network & Operator fees charged in ETH |

Fees calculated on a per-validator basis | Fees calculated on a validator-balance basis via oracles |

Operators sell SSV to cover operating costs | Stake SSV to earn native ETH rewards derived from network fees. |

A New way to help secure Ethereum

Ethereum’s validator landscape has shifted from validator balances capped at 32 ETH to consolidated setups where a single validator can represent far more stake (up to 2,048 ETH post-Pectra). In that world, charging fees per validator key is no longer optimal.

Instead of assuming every validator holds the same amount of ETH, the protocol tracks clusterEB and operatorEB and scales network/operator fee updates based on the registered validator's actual effective balance, not just the number of keys registered.

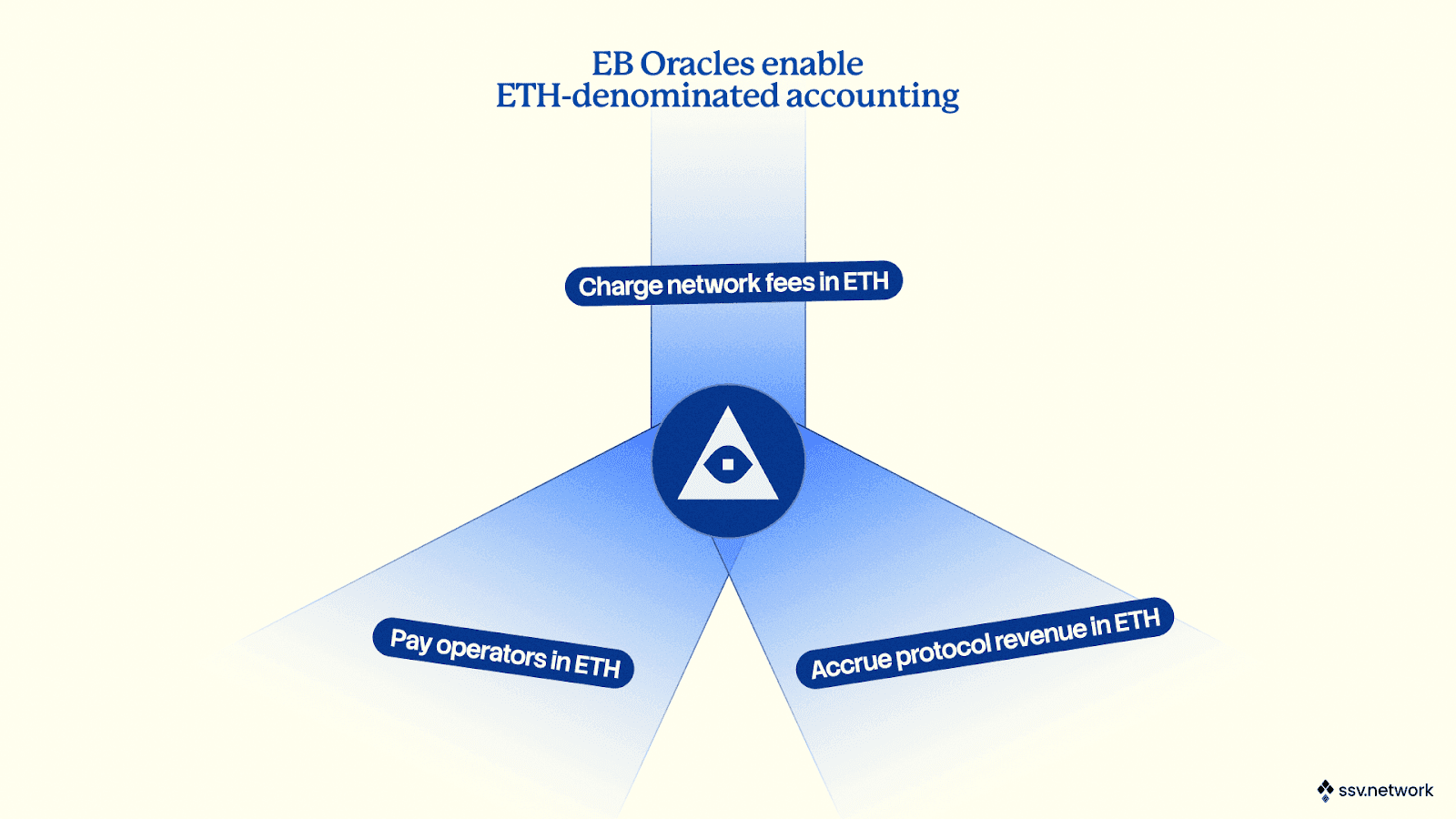

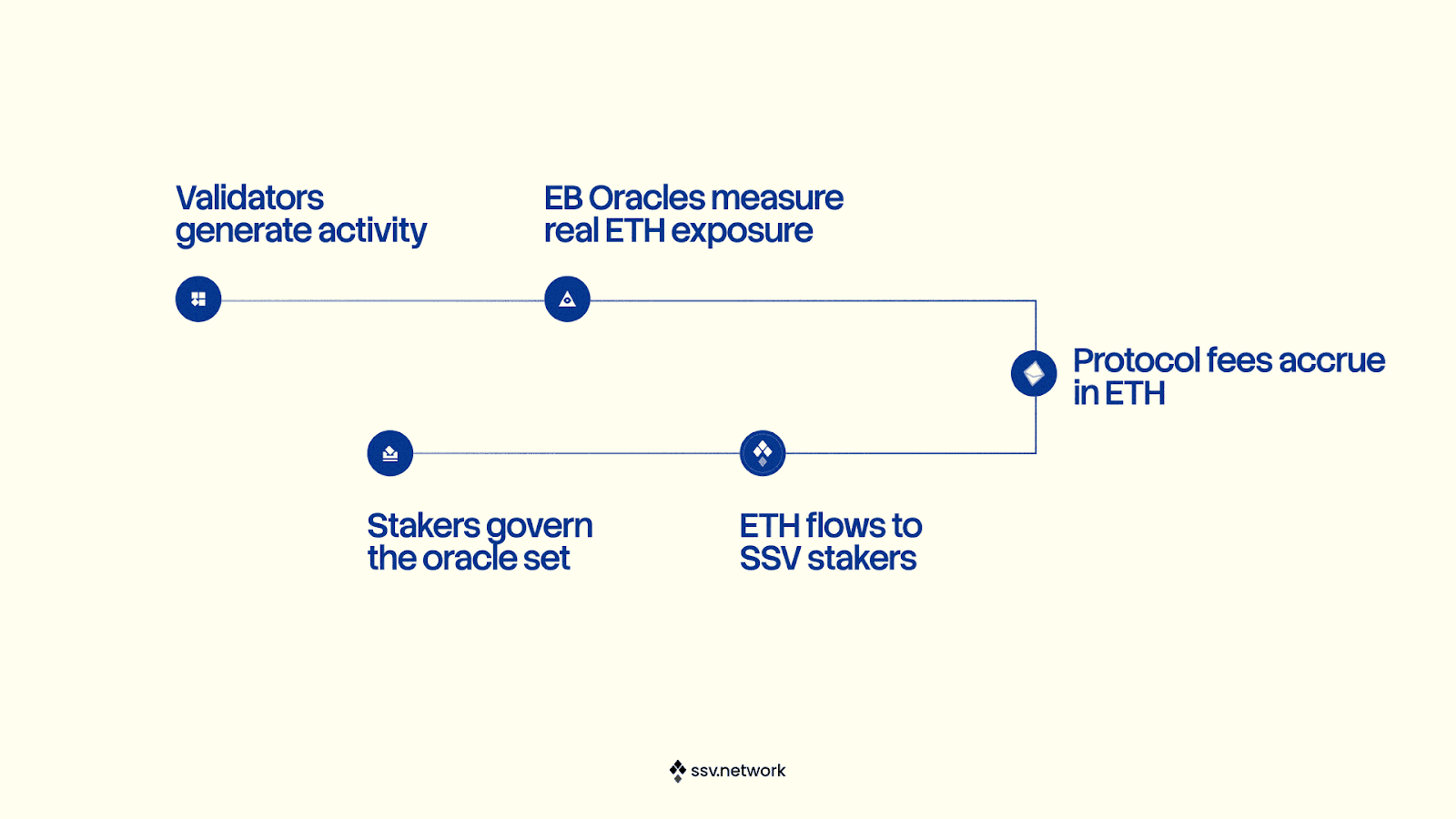

Because effective balance lives on the consensus layer, Effective Balance Oracles are proposed to bring that data on-chain. They read validator balances, aggregate them by cluster, and update storage only when changes cross DAO-defined thresholds, with safeguards that ignore noise, enforce bounds, and settle fees cleanly before applying new EB values.

This is also where ETH-denominated fees matter: clusters pay in the same asset their validators earn, eliminating conversion and hedging overhead. It also makes costs more predictable and operations simpler (ETH balances directly represent runway for budgeting and automation) while lowering a key adoption barrier for institutional and regulated participants who prefer minimizing exposure to additional, non-native tokens.

SSV stakers are an integral part of the process and, in their own way, support Ethereum by supporting SSV's core functions. A new opportunity to earn ETH rewards beyond classical Proof-of-Stake staking on Ethereum.

Stake SSV, stack ETH

The proposed protocol updates convert validator activity on the network into ETH-based fee revenue that flows to stakers, positioning SSV as an ETH-accruing asset embedded in Ethereum’s validator economy. Validator owners pay network fees in ETH when they register and run validators through SSV, and over time, those ETH fees are designed to be routed to SSV stakers, linking SSV’s value directly to the growth of Ethereum’s validator economy.

It’s a new paradigm where: Ethereum activity → ETH fees → SSV holders

The SSV staking APR function:

SSV Staking APR = Total Fees / (Staked SSV * SSV Price)

For a deeper understanding of SSV staking calculations and simulation of the SSV staking rewards, check out the calculator.

SSV staking testnet is on the horizon

Soon you’ll be able to try SSV staking first-hand. The SSV Staking testnet is about to open the gates, giving early adopters a shot at minting cSSV, test the staking experience, and shape what ships to mainnet. This is the call to action for all testers.

The earliest feedback will carry the most weight, so if you want to be among the first to see SSV network fees at work, this is the moment to get in.

Disclaimer: The following represents a vision for the future of SSV Network and is subject to approval by the SSV DAO.