SSV Network Helps Treasuries Navigate ETH Staking

Discover how digital asset treasuries holding ETH can make their asset more secure and productive by running operations on SSV Network.

Corporate ETH treasuries are growing quickly, but a large chunk of that ETH sits unstaked – foregoing billions in predictable, protocol-native rewards. SSV Network lets treasuries stake with complete fault tolerance, segregated key control, and liquidity they can plan around. SSV Network leads Distributed Validator Technology (DVT) adoption at scale, securing 14% (~5M ETH) of all ETH staked; providing the performance, auditability, and uptime institutions require.

The on-chain treasury trend is no longer niche. Coin Metrics finds ETH-focused digital asset treasuries amassed ~2.2M ETH (≈1.8% of supply) in just two months during mid-2025. Evidence that treasuries and institutional programs are moving fast to buy up more ETH.

Despite this momentum, a sizable “yield gap” is still staring them in the face. P2P.org’s State of On-Chain Treasuries 2025 highlights two striking points:

(p2p.org)

At the same time, on-chain fixed-income rails normalized in 2025: tokenized Treasuries and RWAs scaled into the tens of billions, validating professional, yield-bearing instruments on public chains and setting organizational expectations for transparency and programmatic liquidity.

Bottom line: Treasuries now view “on-chain” as a capital-efficient operating venue. The gap isn’t “should we hold ETH?”—it’s “can we stake ETH while ensuring safety, auditability, and liquidity at scale?”

Single-point-of-failure risk: Classic single-operator validators turn infrastructure, software, and jurisdiction into a risk vector. Downtime = missed attestations; misconfigurations = slashing.

Custody catches: Validators have two keys required for operations; one validator private key for signing duties and a public key for withdrawals. You can safely store withdrawal keys, but the validator key needs to be online 24/7. Validator keys must stay online to sign duties and, therefore, cannot be stored securely in cold storage.

Liquidity mismatch: Exit queues and operational bottlenecks clash with redemption SLAs, cash-flow schedules, and NAV stability.

SSV Network’s implementation of Distributed Validator Technology (DVT) runs each validator across a cluster of independent node operators (e.g., 4, 7, 10, 13). Duties are signed by a quorum of nodes, so if one node fails or acts maliciously, the validator stays online. This active-active architecture upgrades staking from “best-effort” to resilient and predictable, fit for treasury policy with heavy fiduciary responsibilities for end investors.

Nowhere else in Ethereum will you find a safer and more customizable staking setup, with added incentives for simply using the tech. SSV Network has come out as the default choice for enterprise Ethereum staking.

2025 Macro Tailwinds

The operational bar is now defined by evidence (immutable logs, operator diversity, uptime SLAs) rather than narrative.

Consider the three pillars of the business case:

(p2p.org)

You don’t need an entire dev team to turn treasury ETH from idle to productive.

Start by setting policy guardrails: choose your custody model (qualified custodian, hybrid, or internal HSMs), and choose your staking partner. i.e, staking as a service, LST/LRT, or operating validators in-house.

If deciding on a staking partner, request that they run on an SSV setup, as a reputable infrastructure provider will have extensive DVT experience. If you run the validators yourself, then choose a diverse operator basket. Either a cluster of your own proprietary operators or a mix of other providers. Ensuring a mix of client, infrastructure, and goelocation setups reap the full decentralization benefits of DVT.

Set your MEV policy (relay-only, conservative, or vanilla), select liquidity rails (liquid staking or tokenized share classes) to meet redemption SLAs. Then pilot in tranches: onboard a small validator cohort under enhanced monitoring; track effectiveness in the high-98s, missed attestations, and incident response. When evaluated and ready, scale with bulk tooling—SSV’s automated onboarding to add validators in predictable waves and wire on-chain metrics (participation, yield variance) directly into FP&A dashboards.

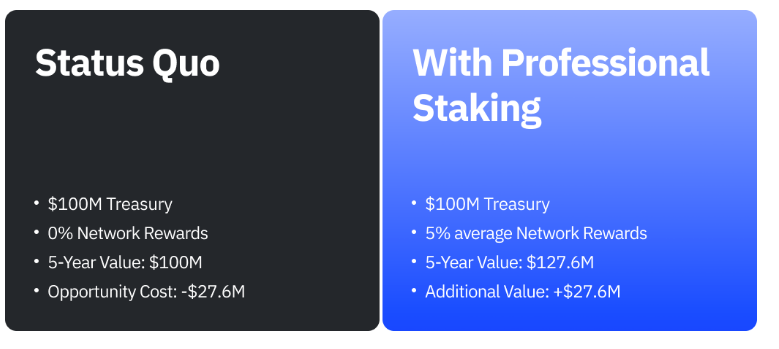

The business case is straightforward. First, a large unstaked base persists across corporate ETH treasuries—translating into billions in foregone, protocol-native rewards each year. This isn’t a risk-on bet; the SEC has already provided guidance on how protocol staking can be conducted as a non-securities activity.

Second, production scale is proven: SSV’s multi-billion-ETH footprint and thousands of independent operators show DVT is not experimental—it’s the operational standard.

Third, comparable programs exist: public filers disclose holdings, staking ratios, and yield, giving you tangible benchmarks for Treasury Policy Memos and Board materials.

If your mandate is capital preservation, risk-adjusted yield, and clean auditability, the path is clear: move from policy to pilot, then scale deliberately with DVT.

Institutional ETH Staking, Done Right.