Token explainer series — Part 2

Operators are an essential part of the ssv.network, for the second part in this series we explain how operator tokenomics function.

Over the coming weeks, we will try to create some clarity around the ssv.network tokenomics design and give you all the tools you need to prep for participating in the Decentralized Staking Economy.

Our goal is to better explain the relationship between the Network’s participants and the role SSV plays in aligning incentives between stakers and Staking Services.

In case you missed out on our previous release, please make sure you check out Part 1 or the explainer series for a more general outline of the network’s tokenomics.

In this post we will cover everything relating to Operator tokenomics. Operators are receiving SSV tokens for running nodes and generating ETH rewards for stakers. Let’s dive in!

Operators are people, companies and communities that run a node in the ssv.network. The node is a dedicated piece of software which allows an Operator to participate in management and operation of validator-key-shares.

In simple terms, when using the ssv.network protocol, a staker splits her keys to a ‘key-shares’. The key-shares are then distributed to 4 or more Operators in the network. The Operators will then work under consensus (iBFT) to secure the Ethereum protocol and receive rewards for stakers.

At present, there are over 3,000 registered Operators in the ssv.network(INSANE!), and that number is constantly growing. The currently active Operators vary between large staking service companies (Allnodes, Stakewise, RockX etc.) through at home DIY Operators.

Operators can determine their own fees, denominated in SSV tokens. We covered this point in Part 1 of the explainer series; ssv.network is an open, free market for staking services. Fees and performance are completely transparent, and everyone competes with one another to attract more stakers(ETH).

Operators can change their fees at any point in time. There might be a situation where an operator is trying to be more competitive and adjusts their fee lower.

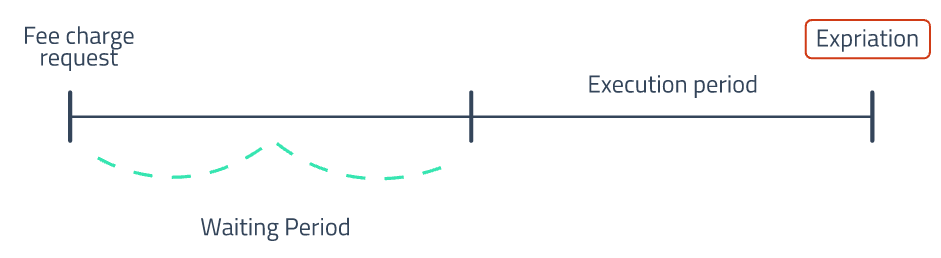

In order to protect stakers from sudden changes in their Operator costs, a fee change has a few built-in limitations:

Operator fee change has a time lag from the point at which a change was broadcasted to the network until the actual change can be executed. Think of it as a large retailer announcing that prices will go up as of next week so their customers have time to react accordingly and not get an unpleasant surprise at checkout.

Fee change cycle, steps an limitations:

Anyone can become an Operator in the network. Only a selected few will become ‘Verified Operators’. VOs are a curated list of Operators which are usually run by POS professionals and can be generally perceived as a safer option for stakers. See DAO vote.

Anyone can submit a proposal to become a VO, however, the credentials you need to present to the DAO are harder to come by. The DAO will eventually determine who is eligible to become a VO by a Snapshot vote.

Having 3,000 nodes to choose from is great for decentralization but can also create unnecessary overhead for protocol users. A curated list of Operators which will be publically marked as ‘Verified’ and constantly monitored by the community will enable users a more streamlined node selection process.

Operators are one of the main pillars of the ssv.network. The more stakers(ETH) an Operator is able to attract the higher their potential revenue from running a node in the network. Operators will be subject to extreme transparency; anyone will be able to see how well they are performing, the tech they are running and their service cost.

ssv.network will be unique in the way service providers are competing for network effect. Today, most services are measured mostly by the amount of ETH at stake. The more ETH is staked with your service, the higher your chances of attracting more ETH. When it comes to ssv.network, there are more variables at play; network participants will be able to have more granularity when choosing you as an Operator.

This will pave the way for lowering staking costs for stakers, providing smaller “long-tail” staking services a real chance to compete for stakers’ attention and potentially even promote client diversity.