SSV Builders: Blockscape – Decentralized Institutional ETH Staking

Blockscape is building an institutional liquid staking service for Institutions using various SSV infra and ecosystem partner technologies.

Any model of a healthy ecosystem will have examples of symbiotic relationships. In crypto ecosystems, builders leverage each other’s tech to incentivize mutually sustained growth, and when looking at the ssv.network DAO, there are a good few of these being cultivated. Here projects work together like building blocks, ensuring the whole can be greater than the sum of its parts.

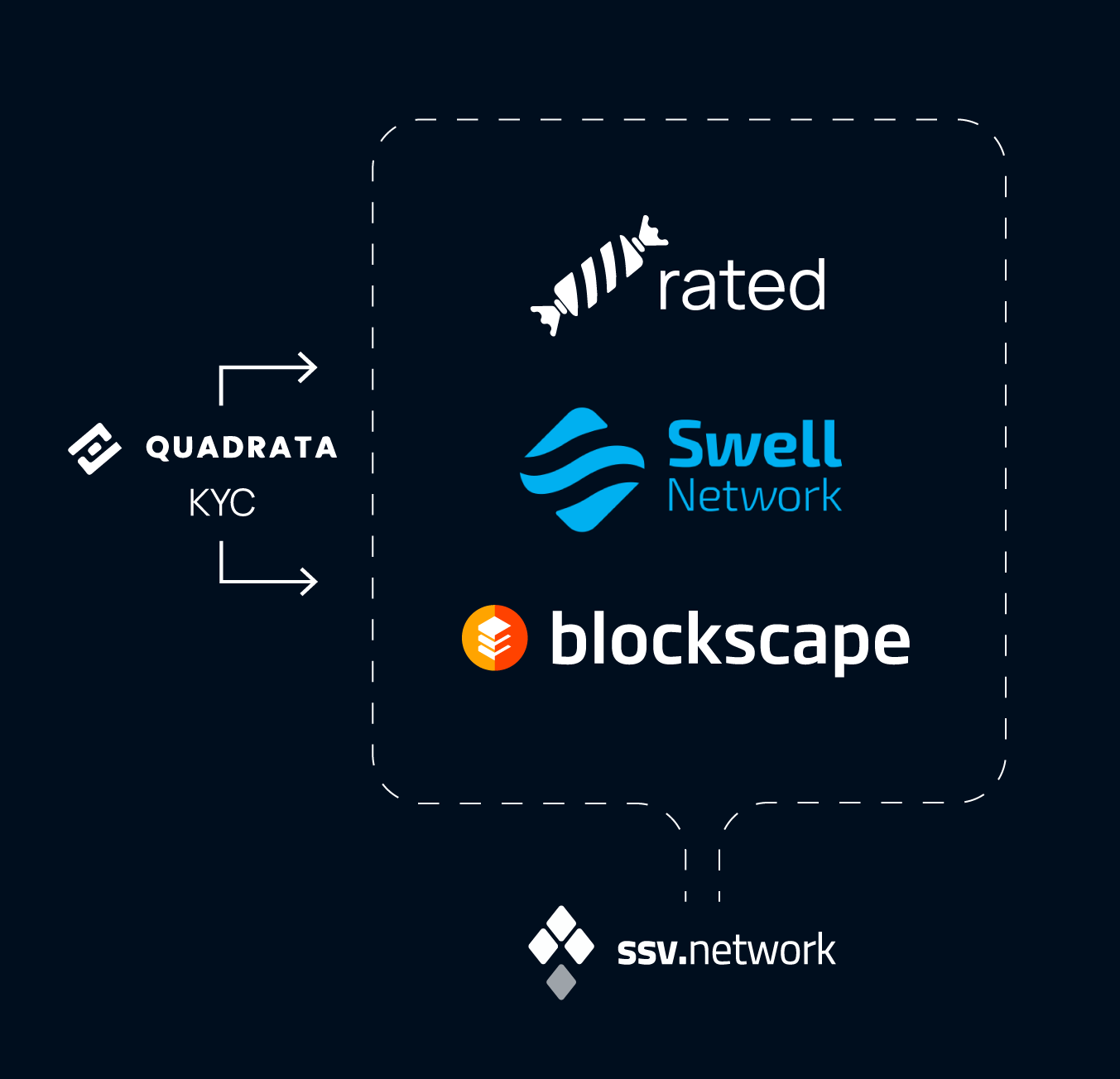

In this post, we’ll give you more details about the collaboration project spearheaded by Blockscape. Including two ssv.network partners (Swell Network, Rated.Network), and Quadrata, who are in the process of building a decentralized liquid staking service for institutional investors.

Located in crypto-friendly Switzerland, Blockscape was one of the first SSV ecosystem partners to receive a development grant. Currently specialists in the operation of resilient and highly-secure validators in over 20 PoS networks, the team started their journey working on PoS validation for the Cosmos network before staking was a twinkle in Ethereum’s eye. Now that The Merge has finalized, the grant call completed, and Phase 1 initiated, the team has started building their institutional liquid staking service on Ethereum.

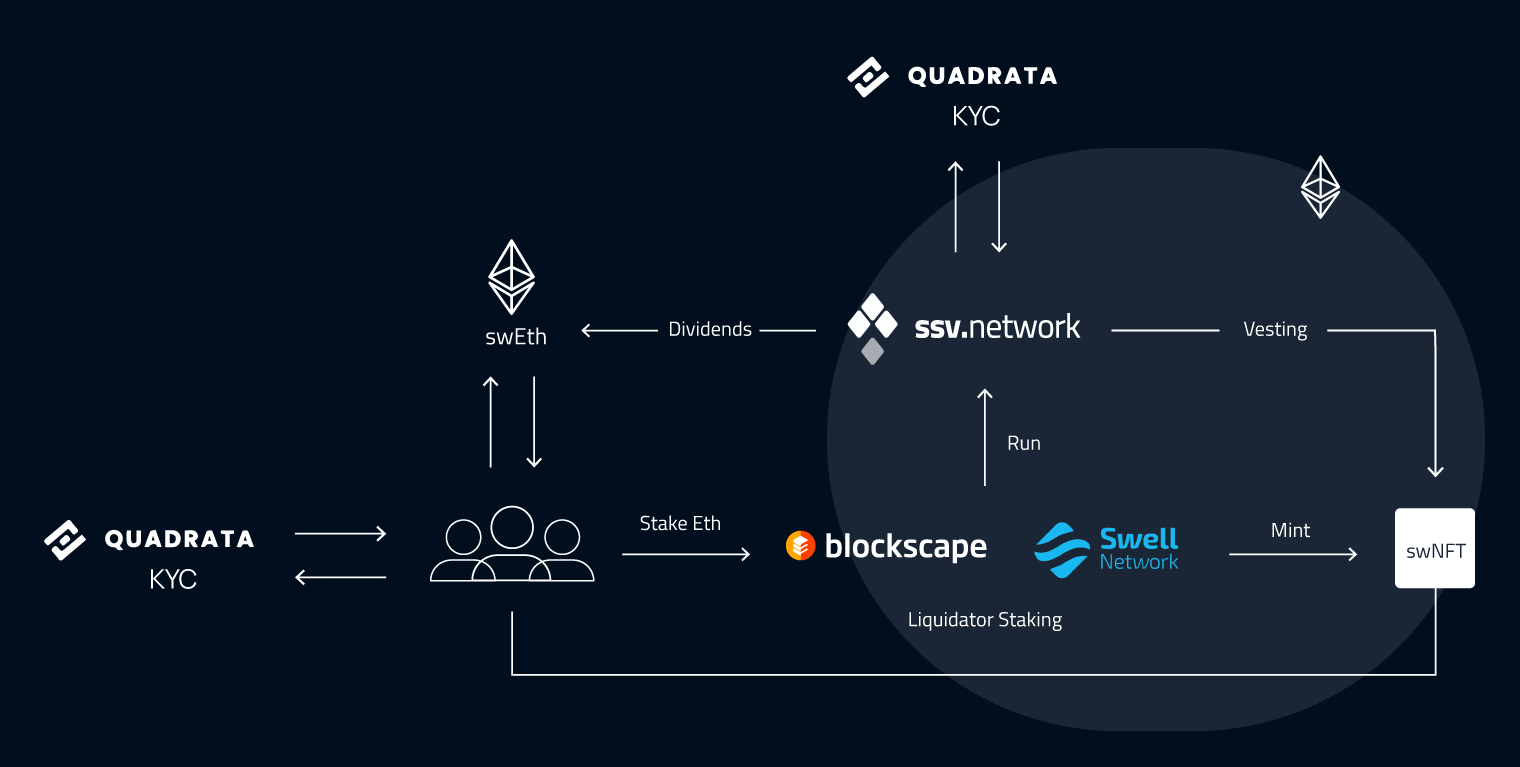

Liquid staking is becoming more popular amongst Eth-based DeFi protocols because, at the end of the day, it makes more economic sense than just locking up ETH and letting it sit there for APR. This concept also makes more sense for institutional investors who want to leverage their assets. To power the next wave of Web3 institutional capital will play an essential role in the continued growth of the Ethereum network. However, institutional conditions to participate in staking are much more uncompromising because of their risk, asset custody, and compliance needs.

In a nutshell, Blockscape is building a way for institutional investors to invest safely and directly into a secure set of distributed operators while making staking rewards liquid or compoundable/tradable via a financial NFT.

By bringing together all of their expertise, the Blockscape team has started working on an institutional liquid staking service by integrating:

The development of Blockscape’s service will enable operators in the ssv.network to capture institutional funds after completing an application process and reviewing their metrics. The application requires that operators provide stakers with geolocation, client information, company name, etc. This unique value proposition will give the needed transparency to institutions by enabling institutional investors to know precisely who they stake with.

After being accepted, institutions can access operators through the provided white label front end, and according to Blockscape, “The result will be a seamless investing/staking experience for institutions under a full self-regulated environment.”

For more information on how Swell’s financial NFT works under the hood, check out their grant call or the grant application.

To turn this blueprint into reality, the ssv.network Grant Committee has played a catalyzing role in this process. Check out the other DAO grants to see what the ssv.network DAO is building, and for more background info on Rated and other ecosystem partners, look at the Collaboration calls or SSV Network Hub.

Website | Network Hub | Discord | Dev Center | Documentation | GitHub