Unveiling the ssv.network Mainnet: Shaping the Future of Distributed ETH Staking

Mainnet has arrived! Learn all about the ssv.network rollout plan and each phase that will need to happen to get to mainnet.

We are excited to announce the ssv.network Mainnet launch has finally arrived! It’s almost time to experience ETH staking on the first-of-its-kind DVT Network.

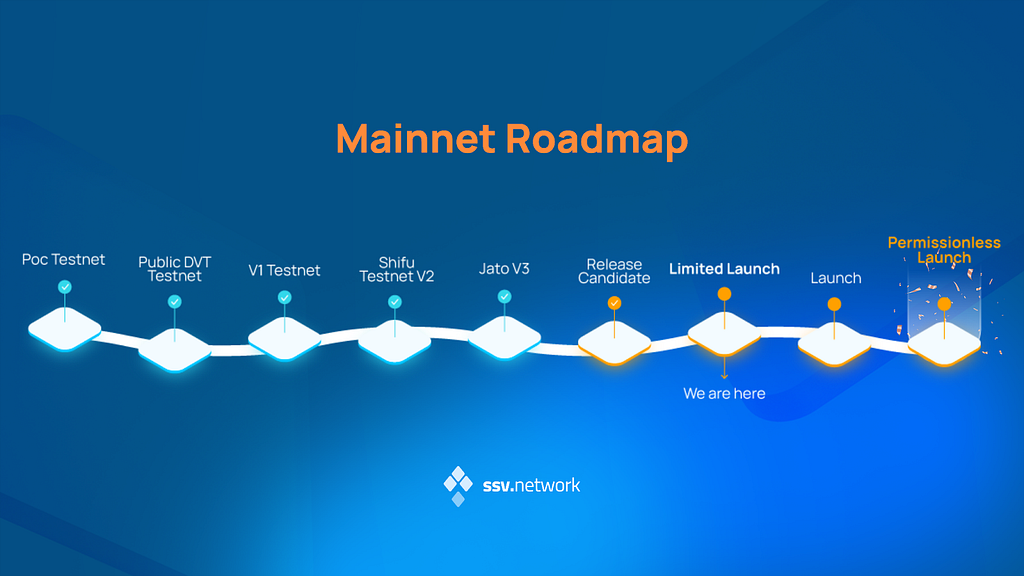

From humble beginnings to testnet milestones, we’ve built a robust infrastructure tackling fundamental Ethereum validator challenges, including fault tolerance, security, zero-coordination, and diversity.

Today we’ll share our rollout plan to provide transparency about our schedules for going live on Ethereum. Keep an eye on this space and join in the revolution shaping the staking industry.

“We are what we repeatedly do. Excellence, then, is not an act, but a habit.” — Aristotle.

Building and shaping the ssv.network has echoed these words. Creating something so intricate takes time and consistent effort. After more than two years of testing and refining, the ssv.network is ready to roll out.

Since our inception, the purpose has been clear: to align with the core principles of Ethereum and empower its validation layer. This shared ethos has driven us to develop ssv.network, a decentralized and permissionless network that invites everyone to join in shaping a more robust ecosystem. By embracing this vision, we aim to bolster Ethereum’s resilience and empower developers to help build and decentralize the network.

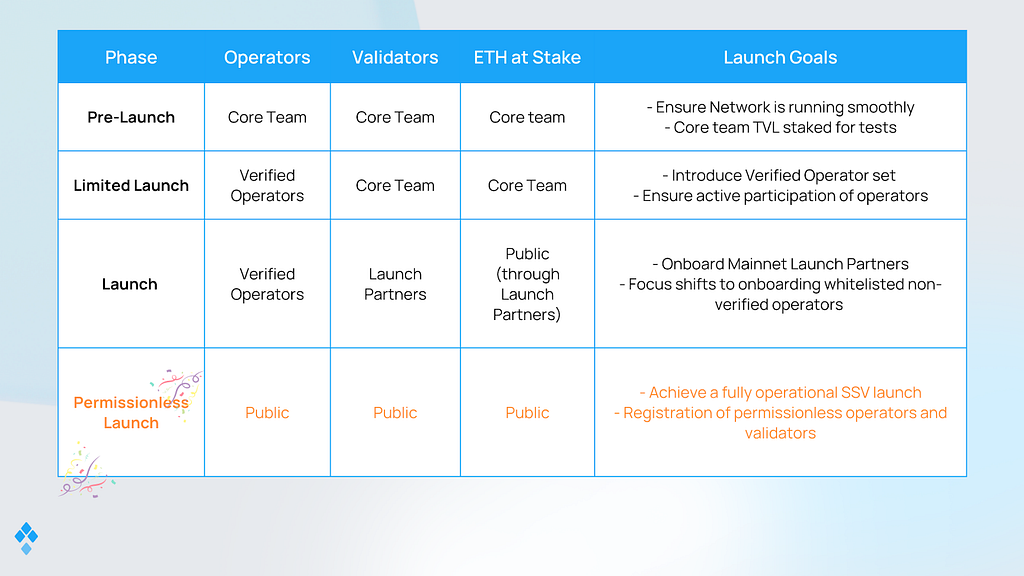

We will start the first phase of the mainnet rollout in early Q2 2023. There are four phases, each with its own goals and provisions. By Q4 2023, the network will be ready for its full permissionless launch. This is a complex process and the timelines are not set in stone. With that in mind we are ready to change the future of staking.

There are various important reasons for following a phased approach compared to doing a fully permissionless launch off the bat. By following these rollout stages, we aim to ensure a smooth and progressive launch of ssv.network mainnet, gradually expanding participation and inaugurating its rich ecosystem.

Stage 1: Pre-Launch

During this initial stage, the main goal is to ensure all mainnet parameters are correctly configured. The focus is on running a few permissioned validators and operators as a sanity check to ensure a smooth launch. The risk of staking ETH on the Ethereum mainnet is limited to only the core team during this phase. We want to ensure users don’t lose their ETH if something goes wrong.

Stage 2: Limited Launch

When we are sure the network is stable for the next phase. The objective is to introduce a complete set of verified operators. Verified operators are tried and tested node runners, ensuring high performance for validators. The primary goal is to ensure the active participation of these verified operators.

Stage 3: Launch

Here we introduce the builders utilizing ssv.network infrastructure, a.k.a Mainnet Partners! These are some of our grant recipients and the staking projects that have pledged to launch alongside us. Publicly staked ETH will be introduced via these partners, allowing broader participation. During the launch stage, the focus shifts to onboarding whitelisted non-verified operators, including up to 100 operators.

Stage 4: Permissionless launch

In the true spirit of SSV, the final stage is the permissionless launch. The objective is to achieve a fully operational ssv.network launch for everyone to join. This includes the registration of permissionless operators and validators to the network. From here on, everyone can use the open protocol to build or stake. An important milestone to moving all staked ETH through DVT.

For more information on the rollout phases, check out our Mainnet Call #1 on Youtube.

Launching ssv.network mainnet is similar to building a highrise building. Each phase is essential and builds upon the completion of the previous one.

Taking a phased approach to roll out a DVT Network is necessary to ensure the many actors and stakeholders in the network are aligned. Launching a network comes with a considerable amount of complexity. And facilitating validators’ trustless and permissionless operation on a meshlike network is no easy task.

For a successful launch and continued growth into the future, we need to ensure the cohesive operation of all the moving parts inside the ssv.network. Establishing a robust flow between various parties has been the key to building a strong ecosystem.

Together they ideate, propose, vote, and implement various initiatives that have brought us to where we are today — a bustling ecosystem with innovation in all directions. We’ve recently started working on the incorporation of the SSV DAO Foundation. This will allow the DAO to make critical decisions and carry out actions outside the digital realm.

Thank you to each individual and organization that has made this launch possible. The people that have taken this over a two-year journey with us and built an ecosystem ready to change the staking game, each playing an essential part in our shared success. It’s been a fantastic ride, and we’re just getting started.

From configuring mainnet parameters to onboarding operators and enabling public TVL, each stage brings us closer to a robust and decentralized network. Join us as we shape the future of distributed ETH staking and become part of an ecosystem that is set to revolutionize the industry.

The countdown to the mainnet launch has begun, and we can’t wait to have you on board.

We aren’t just launching a tech solution but an entire self-sustaining ecosystem. Together, we are forging a more robust future where collaboration and innovation thrive. Stay tuned for the incoming phases.

In the meantime! Join the future of staking and test the tech before we move into the wild. We’ll be releasing more info on how to get ready and join closer to launch day.

Website | Network Hub | Discord | Dev Center | Documentation | GitHub