SSV Token Explainer Series — Part 3

The last episode in the SSV token explainer series dives deeper into the network's tokenomics, token utility, and network liquidators.

Congrats! If you’ve made it this far in the SSV token explainer series, it means you have a pretty good grasp on SSV tokenomics by now. For a quick refresher:

Here, in Part 3, we’ll explore Validator (Staker) tokenomics. As always, our goal is to better explain the relationship between ssv.network’s participants and the role SSV plays in aligning incentives between stakers and Staking Services.

In short, SSV token is used to participate in and shape the Decentralized Staking Economy. To better understand what this means, let’s take a closer look at how things work…

Stakers are anyone who puts their ETH “at stake” and runs a validator using the SSV protocol. Stakers are generally divided into 2 groups:

From the protocol’s perspective, Direct and Indirect stakers are essentially the same. At the end of the day, ETH is batched into 32 pools and a validator is spun-up leveraging the Network’s nodes. Indirect stakers are essentially intermediaries between the core protocol and the end user (similar to the way some staking pools operate today, only safer and more decentralized).

In Part 1, we covered the process of stakers paying operators using SSV. Therefore, to stake using SSV, you must have adequate SSV as a micro amount of SSV will be deducted from your balance after the addition of every new block.

In short, when staking ETH, a validator receives a reward every time a new block is added to the chain. The ETH rewards are generated by operators and in return they are compensated in $SSV.

It’s also important to note — As a staker, you can opt out of the network at any time and retrieve your remaining SSV balance.

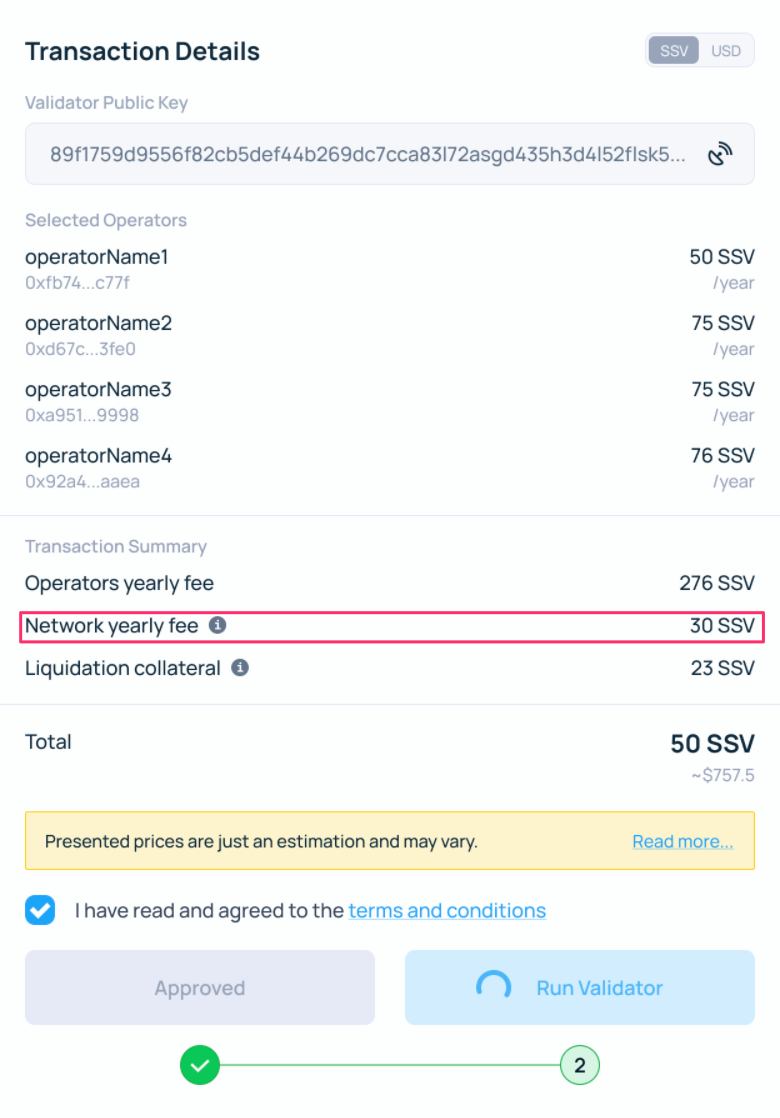

Many people ask, how does the network make money? The answer is, via the ‘Network Fee’. The network fee is a fixed amount of SSV which all stakers are required to pay the Network. The exact amount is determined by the DAO and the revenue generated by network fees will flow directly into the DAO’s treasury.

There are 2 main reasons for having a Network Fee:

So, how much SSV should you keep in your wallet when you stake your ETH on ssv.network? The amount presented to you in the onboarding flow is the amount of SSV that should last you for 1 year of staking. You can certainly have more than that amount or, alternatively, keep a balance that will last for a shorter period of time. However, at no time should your balance drop below the ‘Minimum SSV balance (MSB)’.

The MSB is configured by the DAO. The idea behind the MSB is to ensure that operators are always compensated for their work. You see, the network’s smart contract operates like a balance sheet. The user’s SSV balances are the “assets”. Payments due to Operators for a set amount of blocks are the “liabilities”. In order for the smart contract to avoid going into default, assets can never be less than liabilities..

For that reason, stakers are required to keep some balance of SSV in their wallets. However, the exact amount required is derived from each individual staker’s operator costs. The more expensive your chosen operators are, the higher your MSB will be.

A Staker that allows their SSV balance to go below the Minimum SSV Balance risks liquidation. In such a scenario, their remaining SSV balance will be liquidated and their validator will cease to be supported by the network. It’s important to note that the staker’s staked ETH is not compromised in any way and they are still able to move their validator elsewhere or restake it using ssv.network.

Simply put, liquidators are specific nodes that keep a watch over all of the deposited balances and liquidate wallets when their balance goes below MSB. Liquidators are compensated when they execute successful liquidations.

The idea of liquidation might be a little frightening for some users, however, you can avoid the chances of liquidation by making sure you have enough SSV in your wallet to cover 6+ months of staking fees. Then, check your account balance every once in a while, similar to how you check on your Defi loan status or your AWS billing. Make sure your provider is being paid and you’ll receive uninterrupted operator services.

Staking using ssv.network’s protocol requires ETH and SSV. The SSV token and protocol are one by design. No scenario exists where ssv.network is widely adopted and its native token is not a part of the success.

Our native token allows us to align benefits of participants. In addition, it has allowed us to create a vibrant testnet for developers to build next-gen SSV/DVT-based staking services on. ETH is necessary to participate in the Ethereum ecosystem. We view SSV in the same way — it is necessary to participate in the ssv.network.

SSV is your ticket to the Decentralized Staking Economy. Enjoy the ride!