Test, Build, Go Based – The SSV 2.0 Testnet is Here

SSV2.0 Testnet is live on Hoodi! Build Based Apps, strategies & delegations. Cut security costs by 90% and boost validator rewards.

The SSV Network DAO is excited to see SSV Labs launch the SSV2.0 testnet for based applications on Hoodi!

This testnet will be the first time anyone can develop based applications, strategies, and delegate. If these terms are unfamiliar to you, this post has you covered. It will also outline how to get started, whether you’re a developer, staker, or DeFi OG who wants to build rewarding strategies that power the based economy.

To peek under the hood of SSV2.0, the whitepaper is available here.

Start testing all the new features on the updated web app on Hoodi testnet.

TL;DR

The SSV2.0 Testnet is live; experiment with Based Applications (bApps), strategies, and delegations—unlocking Ethereum’s most untapped asset, the validator. Compared to restaking, bApps cut security costs by 90% with adjustable risk settings, are fast to deploy, and scale effortlessly. Meanwhile, delegations, deposits, and strategies offer new ways to earn rewards beyond staking and DeFi.

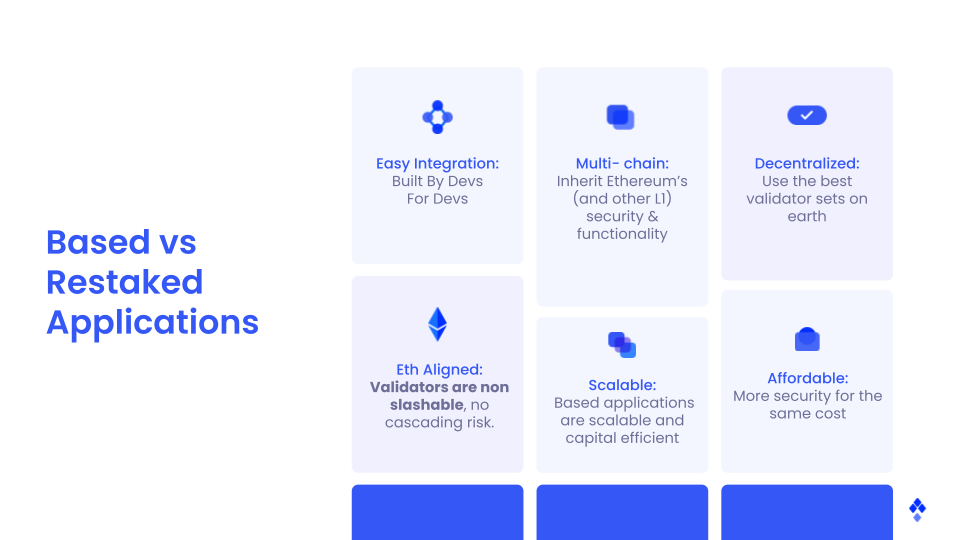

Layer 1(L1) validators are blockchains’ most underutilized asset. By tapping into this asset class, SSV2.0 enables validators to directly secure multiple Based Applications (bApps) without the need to lock-up extra capital – boosting their rewards while reducing security costs for developers by up to 90%. This new paradigm transforms the zero-sum race for capital in the shared security landscape into an infinite-sum economy. With SSV2.0, validators maximize rewards by opting into bApps, developers save on security, and Ethereum’s validator set powers a more efficient, scalable, and based ecosystem.

In SSV2.0, security is validator-first, apps and services are fast to deploy, easy to scale, and fully customizable. Setting adjustable risk parameters allows the network to balance capital allocation and security needs effectively across various bApp types, considering a wide range of participation from validator balance to any ERC-20 tokens. This enables users to adjust their exposure for an optimized risk:reward ratio.

For any existing protocols with a validator set, bApps also present a permissionless gateway to boost participation and growth in their networks. By allowing validator sets to opt into bApps, they can gain an edge in the market, attracting new node operators and stakers by maximising the rewards of their validators. Solo stakers can also capture more value by simply tapping into these new revenue streams.

Based Applications (bApps) represent a new category of decentralized applications that directly harness Ethereum’s validator set to secure any off-chain services or applications. In the SSV2.0 framework, there are three non-exclusive roles: bApps, strategies, and delegations. Each of these works together to create a new paradigm for shared security that’s more cost-efficient, scalable, and Ethereum-aligned.

Easy Integration:

bApps utilize a seamless way to bootstrap by simply letting stakers and Ethereum validators – later other L1 validators – opt in to provide security. Utilizing non-slashable assets (rather than primarily slashable capital) augments security and accelerates deployment. A bApp can be any mission-critical app or service, such as based rollups, co-processors, oracles, bridges, AI, or even support novel use cases like preconfirmations and based sequencing.

Capital-efficient:

Security drives blockchain costs, but bApps actively combine non-slashable and slashable capital (based on bApp needs), cutting expenses by up to 90% while matching restaking models’ security.

Rewards for bApp stakers:

A bApp developer distributes rewards to encourage stakers to commit capital, boosting the total staked amount and enhancing security while motivating participants to adhere to the protocol and deterring attacks. Since slashable assets carry higher risk compared to non-slashable ones, their annual percentage rates (APRs) would typically differ, with rewards for non-slashable assets expected to be lower, reflecting their reduced risk profile.

Risk-Adjustable & Scalable:

The bApp deployer can set an adjustable risk level for all the assets it accepts. This is a list of β values, representing the exposure each token has when the same type of tokens are being allocated to multiple bApps in the same strategy. For example, bApps that want to bootstrap quickly can take on more risk, making it easier for more deposits to flow into them.

In contrast, bApps with strict requirements or specific needs can opt for a lower risk tolerance. This adjustable risk setup gives bApps a unique edge, balancing accessibility and security costs in a way that fits the needs of any use case.

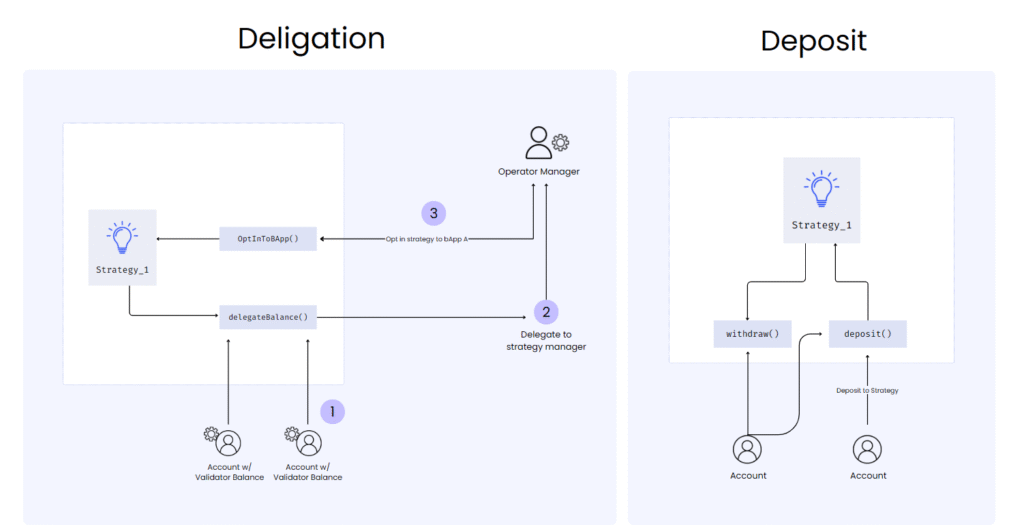

Delegating is when a validator owner (validator registered on SSV Network) delegates non-slashable security to bApps via an account. The account can then use these assets in a strategy. On the other hand, non-slashable assets are deposited directly into a strategy. This is because deposits are actual deposits of slashable assets into the contract, and delegations represent the ETH principal staked on the Beacon chain.

Strategies are comparable to the vaults seen in various staking platforms like Mellow insofar as they contain different kinds of assets and distribute rewards. With SSV2.0, strategies actively secure bApp(s) they opt into by using delegated assets. Independent of the bApp, strategies allow bApp owners to bootstrap their bApp, empowering other delegators and depositors to participate.

Non-slashable Security:

When delegating non-slashable assets (validator balance) to an account, it is leveraged for each bApp in the strategy. A strategy can use the validator balance of its owner account. For example, 1 account has 4 strategies, each securing 1 bApp. Assuming the strategy is delegated 100 ETH worth of validator balance, the 100 ETH is shared between all 4 bApps. This means that each bApp in the strategy will have 100 ETH worth of security. Because validator balance is a non-slashable asset, it can be spread across different strategies to provide a larger base of security for many different bApps, simultaneously increasing their rewards. Win-win.

Obligation Ratio:

Strategies can independently set the obligation ratio for slashable assets in the bApps they secure. This ratio determines the voting power given to obligated capital. For example, one strategy secures two bApps. bApp 1 has a 20% obligation, and bApp 2 has an 80% obligation ratio in stETH tokens. Depositing 100 stETH tokens to this strategy will give bApp 1 20stETH and bApp 2 80stETH of slashable security.

Conversely, a strategy can set the obligation ratio of tokens to be over 100%. Reusing the previous example, but both bApp 1 & 2 have 100% obligation, meaning 100% + 100% = 200% obligation. This means both bApp 1 and bApp 2 gain 100 stETH in slashable security, even though you deposit only 100 stETH.

Fees:

Strategy owners set a fee, representing a percentage of the rewards the strategy earns.

Please note: Both the rewards and slashing functionality are still under development.

Participating in the testnet will give early users an edge in the based economy by learning how to interact with the web app and smart contracts before going live on Mainnet. By diving into SSV2.0 now, you’ll gain hands-on experience from experimenting with bApps, fine-tune your strategy, and master delegations in a risk-free environment.

The SSV2.0 testnet launch includes:

This section outlines the flows for developers, strategies, and delegations. Find the complete ‘how-to’ in the docs.

A bApp can be created by using the smart contracts.

Strategies are for everyone! Whether you’re a developer bootstrapping your bApp with your strategy, or a DeFi OG that’s maximising for profitability by securing different bApps, the options are limitless.

The process is frictionless. You simply need to log into the web app with your wallet and start building your strategy.

Delegations & deposits are the lifeblood of bApps. To delegate validator balance, an account must have a validator registered on the SSV Network. That account will be able to secure its own strategy with validator balance or delegate to other accounts that own strategies.

Deposits (any ERC-20 token) are made directly to the strategy contract. This allows depositors to deposit their slashable assets into the various strategies that accept them and earn rewards. As alluded to previously, slashable assets carry more risk and are therefore expected to have higher returns.

Now that the bApp smart contracts and DVT operations are running on Hoodi, it’s time to say goodbye to Holesky, which was sunset on April 21st, 2025. Existing SSV operators need not migrate; Hoodi launches with a fresh start.

SSV2.0 testnet is your chance to become a pioneer of the based economy! Hit the ground running, be ready to seize opportunities, and lead the charge in the next staking revolution.