The Guide to Institutional ETH Staking with SSV Network

Discover how SSV Network’s DVT architecture enables secure and scalable ETH staking for institutions—resilience, liquidity, and control.

Ethereum’s shift to proof-of-stake has created new opportunities for institutions to earn yield on ETH holdings. But for decision-makers at exchanges, custodians, funds, treasuries, or ETP issuers, staking can feel complex and risky. Questions around security, liquidity, key management, scalability, and compliance often stall adoption.

Distributed Validator Technology (DVT) changes this equation. By splitting validator operations across multiple independent nodes, DVT eliminates single points of failure, strengthens resilience, and enables institutional-grade staking operations.

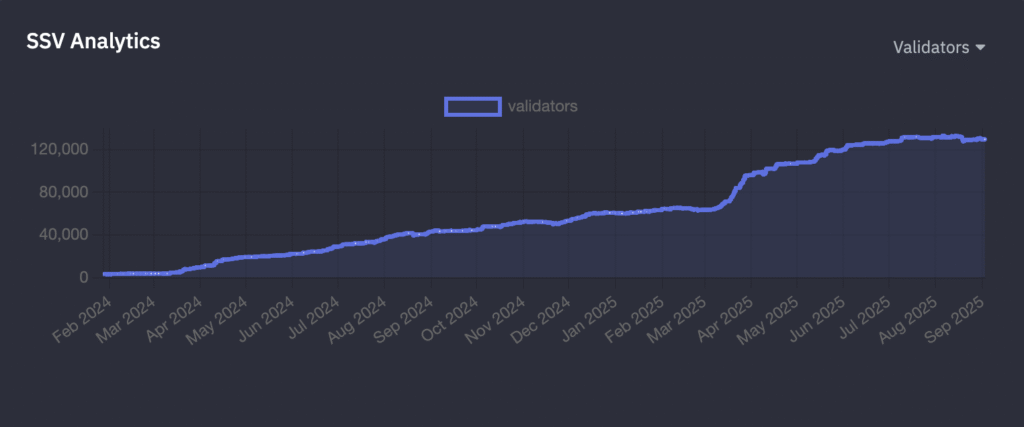

SSV Network is the leading implementation of DVT on Ethereum. Today, it secures over 4.3 million ETH ($18B) across more than 1,800 node operators — totaling around 12% of all ETH staked. It is trusted by global leaders, including exchanges like Kraken, which recently became the first major exchange to fully deploy SSV tech throughout its entire ETH staking operation, serving both institutions and retail customers.

This article explores how SSV Network’s infrastructure helps institutions stake ETH securely and at scale. We’ll examine the core institutional priorities — resilience, risk management, key custody, liquidity, partner ecosystem, scalability, and regulatory alignment — and show why SSV has emerged as the industry’s gold standard for institutional staking.

Resilience is fundamental for institutional staking. Downtime or misconfigured nodes not only reduce rewards but can damage reputation and, in the worst case, trigger slashing penalties. In the legacy validator setup a single node can run multiple validators, requiring each of their private keys to be online 24/7 for singing duties. However, this exposes validators to security risks and downtime via hardware or software failures, or even jurisdictional disputes.

SSV Network provides a distributed validator model. Each validator is operated by 4, 7, 10, or even 13 independent nodes that coordinate duties through a (3n+1) Byzantine fault-tolerant consensus mechanism. Even if one node is offline or malfunctioning, the cluster continues to perform correctly. This active-active redundancy means your validator keeps working through outages, software issues, or even malicious operator behavior.

![[Fig. 1: Diagram of a validator cluster with 4 operators. Three nodes continue validating while one is offline, illustrating fault tolerance.]](https://ssv.network/wp-content/uploads/2025/09/image-1.png)

For institutions, this translates directly into higher uptime, reduced operational risk/overhead, and more predictable returns. When Kraken integrated SSV, it reported a significant optimizations in validator reliability. In practice, this means fewer missed attestations and smoother performance at scale.

Ethereum staking offers attractive, protocol-native yields. For treasuries and others already holding ETH, not staking is leaving additional revenue on the table. However, achieving those yields consistently requires minimizing the risks of downtime and slashing.

Utilizing SSV infrastructure enables:

Institutions gain the best of both worlds: higher rewards through maximized uptime, with dramatically lower risk exposure tailored exactly to their needs.

Custody and key security are non-negotiable for institutions. SSV enables both custodial and non-custodial staking, with flexible key management approaches that fit into institutional risk frameworks. Custodial staking can be done through an institutional grade node operator who can integrate SSV upon request and abstract all key management, SSV key splitting processes and network fees; giving clients the same look and feel as traditional native staking.

![[Fig. 2: Side-by-side illustration of Key Splitting vs. DKG. Key Splitting: whole key split into four encrypted shares. DKG: four operators generate their own key shares, with no complete key ever existing.]](https://ssv.network/wp-content/uploads/2025/09/image-1024x389.png)

Key Splitting vs. Distributed Key Generation (DKG) – in key splitting (left), a validator’s private key is created and then split among multiple operators. In DKG (right), the operators jointly generate the key shares without ever forming a complete private key, offering security with zero single-party custody of the key.

This design means institutions can even stake directly from cold storage. As stated previously – validator keys need to be online 24/7 to sign duties on the beacon chain, but in SSV, keys are encrypted and only the encrypted keyshares are used for signing; meaning private keys can be kept in cold storage. It aligns with regulatory custody requirements by ensuring withdrawal keys stay under institutional control and operators cannot access funds.

One of the biggest concerns for institutions is liquidity and managing redemptions. While ETH staking rewards are attractive, locked assets and exit queues are a challenge for funds and ETP issuers who must honor redemptions.

The SSV DAO is working with partners across the staking ecosystem to solve this:

The result: staked ETH remains productive while still meeting liquidity requirements for institutional products and balance sheets.

Trust in infrastructure comes from real-world battle-testing and earning trust from experience. SSV Network is supported by a wide range of leading custodians, staking providers, and node operators.

The SSV DAO Verified Operator program includes well-known names such as Ankr, Allnodes, Blockscape, DSRV, Everstake, Kiln, P2P.org, RockX, StakeWise, and more. Institutions can select clusters of their preferred operators, balancing geography, software, and performance. Alternatively, those more hands-on involved in validator management can utilize their own nodes to run staking operations on top of SSV Network.

It’s clear that DVT is being adopted at scale. Many staking protocols that service institutions have adopted the technology as part of their offering. This growing partner ecosystem gives institutions confidence that SSV is the gold-standard for enterprise staking.

Institutional staking often involves large allocations — tens or hundreds of thousands of ETH. Infrastructure must handle that scale without bottlenecks as seen in the case study with P2P.org.

The SSV ecosystem is already operating at scale and consistently strives to maximise performance:

The architecture is inherently scalable: each node operator in a cluster can run 3000 validators. With bulk operations, SSV makes onboarding large institutional stake straightforward and low-risk.

Compliance is central to institutional adoption. While regulations continue to evolve, SSV’s design aligns well with key regulatory expectations:

In short, SSV provides a clearer, safer path for institutions to gain product approvals and build compliant staking offerings.

Ethereum staking is no longer just a retail or crypto-native activity. It is rapidly becoming a strategic allocation for big players, offering a steady yield and alignment with Ethereum’s growth. By adopting SSV, institutions gain access to the most secure and resilient staking infrastructure in Ethereum today.

It’s staking, redefined for the institutional era.