It’s Time for EIP-1559 — A Light Overview of the Improvement Proposal

Ethereum's EIP-1559 is on the way with lots of changes coming to the network. Check our overview of what this means for Ethereum.

EIP-1559 has been a hot topic across the Ethereum ecosystem lately as gas fees are at all-time highs and more and more people try to engage with the growing number of DeFi projects and smart contracts available on the network.

Network congestion has become a real problem and even a barrier for newcomers and those with smaller wallet balances. To put it plainly, on Ethereum today,

“People needlessly overpay massively.”

…and often endure wait times that are entirely unnecessary and inefficient. In the current fee model, users bid against each other in a “first price auction” system where transactions are selected and executed by miners. Miners are incentivized to take the highest bids first and consequently many users who are not willing or able to cough up close to $100 for gas in some instances must endure crazy wait times or risk failed transactions.

For close to two years now, EIP-1559 has been in the works to address these scalability growing pains, but it seems they have crept up faster than could be solved for. This is why now more than ever, EIP-1559 is a critical component of the Ethereum roadmap and one that will benefit all factions of the Ethereum ecosystem (yes, miners included).

EIP-1559 is an “Ethereum Improvement Proposal” that modifies the network’s existing fee structure. It is one of the most highly anticipated changes to Ethereum aside from Eth2 and has four primary goals:

To achieve this, a number of new concepts are introduced that will change the volatility of block size, rather than the volatility of fee price</strong >. This is accomplished by implementing the following transaction parameters:

Wallets will be able to calculate the base fee needed for upcoming transactions, which will be much more predictable than today’s fees as it can only fluctuate within a certain range. Users can also be sure that if they select the base fee, their transaction will not be skipped over for a better offer.

If a user wants, they can include a miner tip which will incentivize miners to speed up a transaction, but this transaction will not be at the expense of other transactions that simply paid the base fee; rather, block size will increase to include these transactions when requested.</strong >

Similarly, if a user is willing to wait a little bit for network congestion to decrease, and the base fee to decrease with it, they can select a fee cap of their choice and their transaction will be executed when the base fee declines to the desired price. Effectively, fees are adjusted according to network utilization with the goal of maintaining network capacity equilibrium.</strong >

Many miners are dead set against EIP-1559 and have been calling to stop (or modify) its implementation. They fear that they will not be adequately compensated for their contributions — the upfront pay cut is estimated at around 30% of what they receive today (although it should be noted that the crazy influx of users as of late has increased their income significantly as compared to even a few months ago). It’s clear that many are feeling undervalued:

Ethereum developers initially needed miners for their coin but once successful they’ve thrown them under the bus. They cared about miners when Ethereum lacked mining support, and once they received it, they started to mistreat them. Large pools support the Ethereum Developers because they have large stores of ETH, making them investors themselves. They do not value their miners because they plan to dump them when 2.0 comes. </em >Miners are no longer vital to the Ethereum developers or big mining pools because they’ve made their money, and now miners are an embarrassment.</em ></strong > The developers and big mining pools had forgotten where they came from and supported them when they started out. Remind them that your not a dog. Take your business elsewhere. – </em >stopeip1559.org

It should be said, and rightfully so, that miners have and continue to be an integral part of the Ethereum we all know and love. But the Ethereum that we all have come to appreciate cannot scale without making fundamental changes core to how the network operates.</strong >

It’s important to look at the larger picture of why this is all happening, and the network’s health as a whole. Ethereum in its current state is simply prohibitive for many users due to its astronomical fees and wait times, and if something isn’t done about it, everyone will suffer.

EIP-1559 and Eth2 are not meant to harm anyone, they are meant to facilitate inclusion across the broadest possible spectrum of participants. Operators AND users alike. It should also be noted that the pay cut perceived, is not as great as it may seem given the implications of the feedback loop created if the proposal is indeed implemented.

In addition to improving user transaction experience, EIP-1559 has one more important parameter to consider. Burning of the base fee.

By burning this fee rather than distributing it to miners, a positive feedback loop is created between ETH activity and supply. Taking this fee out of circulation makes ETH more scarce, with the potential to cause a deflationary pressure on total token supply.

Fees currently paid out to miners have a consequence for the overall value of ETH:

While this ETH is created out of nowhere it is effectively paid for by all ETH holders because increased issuance puts downward pressure on prices. — </em >Adrian Sutton</a >

In the short term, reduced fees for mining may appear to the disadvantage of miners, but implementing EIP-1559 has the potential to do the exact opposite — rewarding both miners and all other ETH holders.

EIP-1559 isn’t the only scaling solution in the cards for Ethereum; a fully functional Eth2 is right around the corner and layer 2 scaling options are under development to help the network mature even faster.

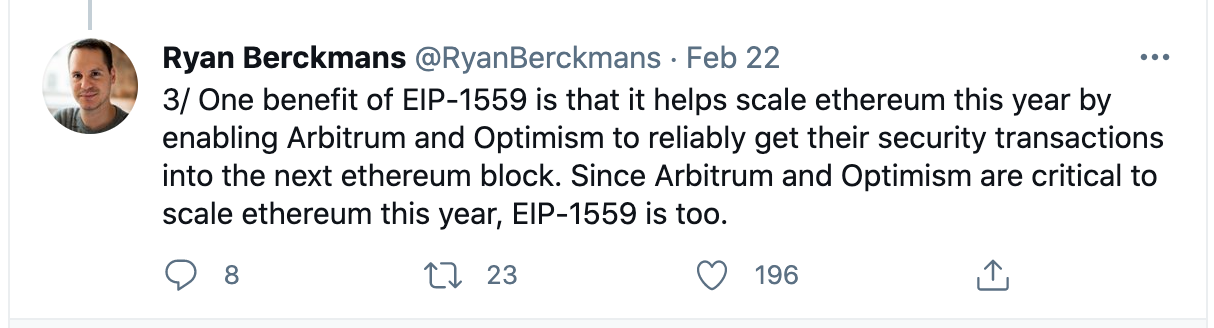

EIP-1559 is slated for the London hard fork in July, should all move ahead smoothly. It will not only provide the immediate benefits discussed above but will also positively support layer 2 scaling projects:

All of these efforts are necessary to welcome and celebrate the droves of users flooding into Ethereum. Let’s support EIP-1559!