SSV Token explainer — Part 1

The first in the series of token explainers to give all the information you need to understand how SSV tokenomics work in the ssv.network.

Over the coming weeks, we will try to create some clarity around the ssv.network tokenomics design and give you all the tools you need to prep for participating in the Decentralized Staking Economy.

Our goal is to better explain the relationship between the Network’s participants and the role SSV plays in aligning incentives between stakers and Staking Services.

In this section, we will cover the basic overview of SSV tokenomics design. By reading part 1, you will have a clear understanding of the token and the way you and others will use it in the next testnet (V2) and, of course, mainet.

If you need a reminder about SSV tech, or The Network feel free to click on the links provided here or simply visit the ssv.network website.

Let’s dive in; SSV token has 2 main uses at this point in time (will have more in the future)

The first use case is pretty straight forward, DAO governance using a native token was deployed successfully for many years in many protocols/projects/communities etc.

The second use case is what essentially aligns the benefits of both stakers (aka Validators) and Operators.

Quick reminder:

Another important aspect to remember about the SSV token is that it is a ‘native’ token to the truest meaning of the word. It’s impossible to use the ssv.network protocol without SSV tokens. We wanted to avoid a scenario in which the protocol is well adopted and the token is not part of its success. The protocol and the SSV token are intertwined.

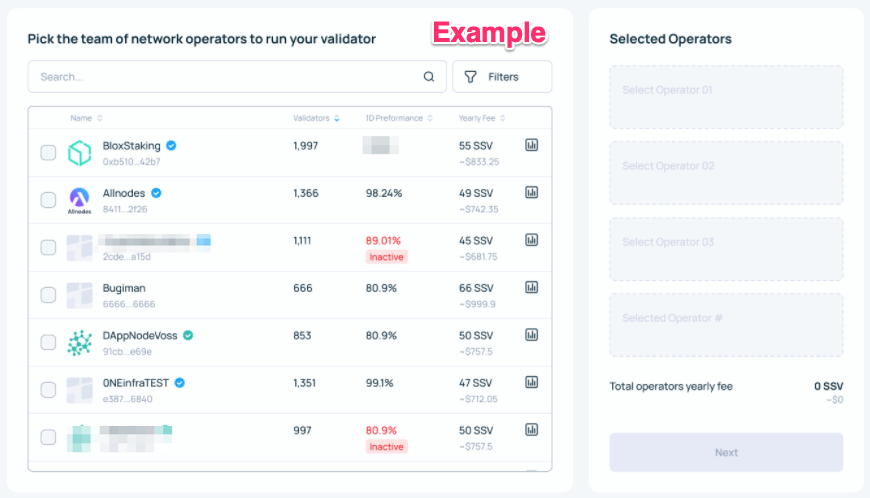

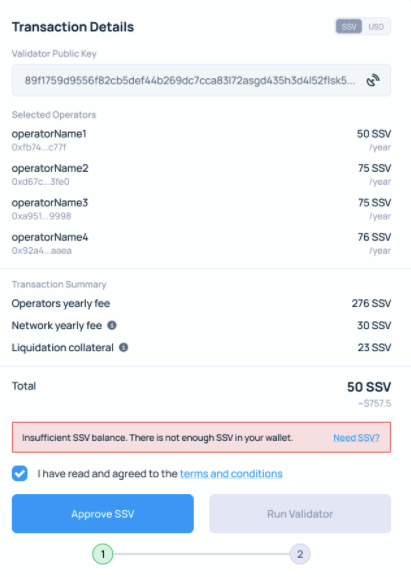

Before starting to stake in the network you are required to choose 4 or more operators to manage your validator. Those Operators can set their own fee, which is denominated in SSV tokens.

After choosing your Operators, you will be required to deposit a minimum amount of SSV tokens for the Operators to start managing your validator and receive you ETH rewards.

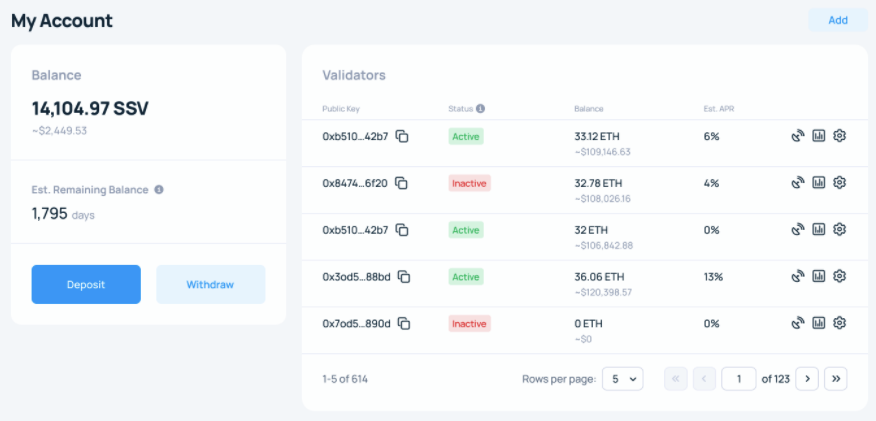

Once you start staking and receiving ETH rewards a “micro-fee” will be deducted from your SSV balance each block.

It’s important to note that as a staker, you are in control. You can stop staking at any point in time and retrieve your unused SSV balance. You can also change 1 or more of the Operators you originally chose to optimize your staking costs.

In addition, your crypto assets are completely segregated from the network. The ETH generated flows directly to your validator (no intermediary). The SSV you own is deposited in an address only you control.

Simple answer, it’s totally up to you. The ssv.network is designed as a ‘free-open-market’ for staking services that openly compete for your SSV. Each Operator in the network is able to determine its own cost and compete with the rest of the operators in the network.

Transparency is extremely important in Blockchain and especially when it comes to staking. The network is set up in a way that allows you to make optimal choices when it comes to the Operators you interact with, as well as the ability to be agile and easily change a service provider if you believe you have found a better alternative.

In coming posts we will cover more in-depth topics relating to SSV tokenomics:

The token model described in the series is already in late stage of implementation and will be available in the next testnet iteration (V2). The smart contract layer involving the SSV token integration into the protocol has been in the works for many months and will soon be available for public testing.

Exciting times ahead.