Rise of Composable Staking Technologies

As the Ethereum staking ecosystem continues to evolve, the composability of technologies has emerged as a crucial factor for improving various pain points. The DeFi Legos, were applications “build on each other” to enable lending, borrowing, and other yield-generating opportunities is a good example. Similar to DeFi, the staking legos have forever changed the landscape by promoting participation in Ethereum’s consensus layer, improving capital efficiency, yield, and the network’s overall health.

This blog post will explore how SSV Network’s distributed validator technology (DVT) infrastructure is seamlessly composable with re/staking applications, how Distributed native restaking works, and how composable technologies bring forth a new frontier in staking.

TL;DR

- Understanding the different layers of the staking legos.

- What is Distributed Native Restaking?

- Stacking protocol rewards with SSV

- SSV as a Standard for Base Layer Resilience

- Guide: How to do distributed native restaking with SSV

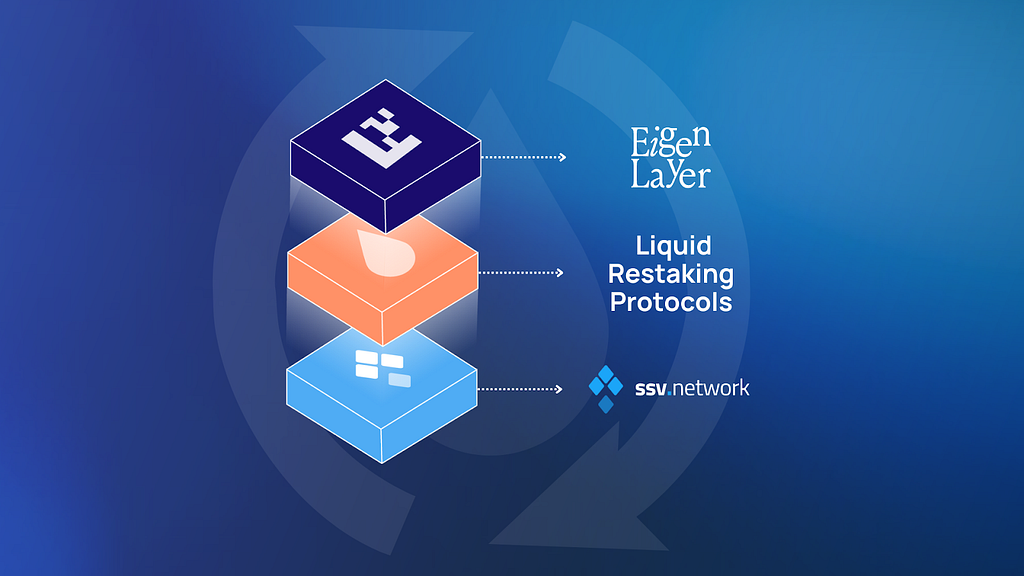

The Staking Legos — DVT, LSPs, and Restaking

When thinking about the staking legos, one can imagine them (as the name suggests) as building blocks that fit together. The whole is indeed greater than the sum of its parts.

On the base layer, there is the Beacon Chain and native ETH rewards generated by validators attesting and adding transactions to the blockchain.

On top of that is SSV Network DVT infrastructure, which provides a decentralized validator layer that solo-stakers and any staking application can easily utilize. DVT enables the secure and fault-tolerant operation of an ETH validator by multiple non-trusting parties, thus helping to secure and decentralize Ethereum’s base layer.

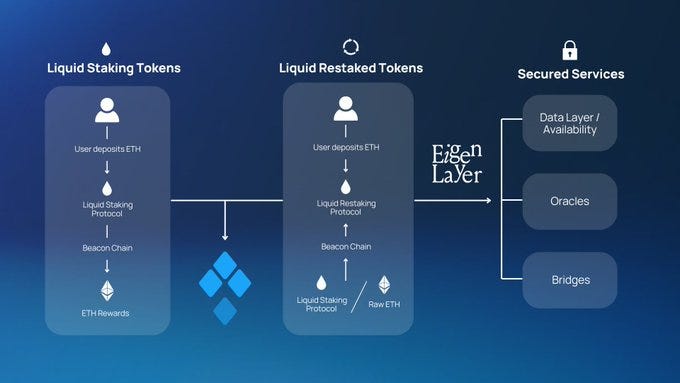

The next layer is Liquid staking protocols (LSPs). Lido unlocked the liquidity of staked assets in Ethereum by minting and issuing derivatives — liquid Staking Tokens (LSTs) — that can be reused in DeFi. This allows users to earn staking rewards on Ethereum without locking up assets, bringing capital efficiency into the game.

In a non-DVT setup, Liquid Staking Protocols batch user deposits for a sum of 32 to run a native Ethereum validator. This setup does not often meet proper decentralization and security standards as the node operators are usually located in a singular geo-location, utilize only 1 or 2 EL/CL clients, or keep the validator private key online.

Liquid Staking Protocols can leverage DVT by routing their validators to SSV’s network of node operators, instead of creating/using their own. All with a simple smart-contract interaction. For every ETH staked with the LSP, stakers will receive an LST in a 1:1 ratio, but the underlying ETH is always staked to the base layer.

The next layer is Restaking. It enables a new method for yield generation by extending Ethereum’s cryptoeconomic security to Actively Validated Services (AVSs) on EigenLayer. By restaking ETH or LSTs with an Eigenlayer operator, AVSs can be secured by a novel dual staking paradigm. In return for restaking and securing these additional protocols/services, stakers will receive rewards.

LRTs break the mold by introducing the development of multi-protocol staking. Through EigenLayer, stakers can diversify their rewards by staking across multiple Actively Validated Services (AVS).

Important reminder: If the base layer goes down, so does Restaking, this is why DVT is crucial.

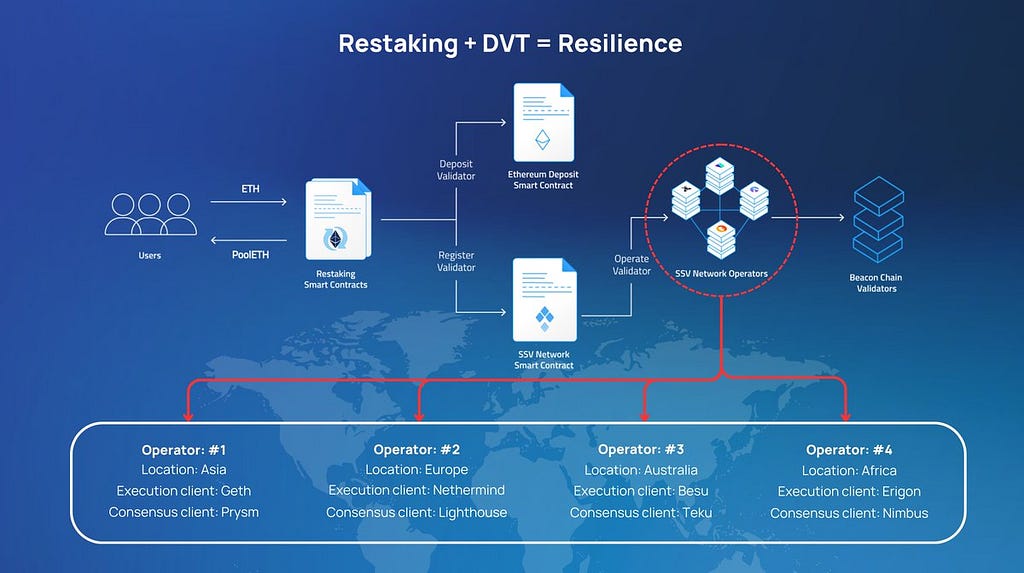

Distributed Native Restaking — This is the term SSV uses to explain a setup where the validator taking part in restaking uses DVT as its underlying infrastructure.

- Distributed Native Restaking with SSV:

As a solo-staker, when an ETH validator is registered to the ssv.network; the validator is distributed between multiple non-trusting nodes for maximum uptime and fault tolerance. To restake natively, all users have to do is create an Eigenpod (smart contract by EigenLayer, which the user deploys and is the owner of) and set their validator’s withdrawal credentials to the pod address to earn staking points. Now, stakers can earn both Beacon Chain rewards and restaking rewards with a resilient and decentralized base layer. - DVT-powered LST Restaking with SSV:

For every 1 LST issued, 1 ETH must be staked on the base layer.

Similar to Distributed Native Restaking, LSPs have validators operated on SSV Network. This enables stakers with less than 32 ETH to stake with an LSP and then restake the LST to EigenLayer. LST restaking allows stakers to gain extra yield by earning rewards on restaked LSTs and their ETH principle. For example, staking on Lido and then restaking stETH on EigenLayer.

From an LSP’s perspective, they can point each new validator’s withdrawal address to an Eigenpod to earn restaking rewards for users while keeping the underlying operator infrastructure secured with DVT. Service providers can now give stakers both Beacon chain + restaking rewards in a liquid token representation — voila, an LRT is born.

Important note: This means that LSPs can also be AVS operators, creating a new revenue stream for them (the roles are not mutually exclusive). And vice versa, if they’re not an AVS operator, they would delegate to an operator, and users need to know the risk associated with those operators.

Eventually, all LSPs could be LRTs and LRTs could be AVS operators as well. This puts the impetus on the staker to do research on LRTs regarding operator metrics and operational procedures like key security, DVT usage, etc.

More on this further down, but first…

Stacking Protocol Rewards

As we can see, it’s possible to stack protocol rewards by layering services. Various services currently utilize the staking legos to boost yield way above the average earned only from the Beacon Chain.

- 1st Layer Rewards — Consensus layer rewards (ETH)

- 2nd Layer Rewards — SSV Incentivization program (SSV)

- 3rd Layer Rewards — Restaking Points (At the moment, points are utilized since EigenLayer is on testnet; in the future, users will get rewards)

By staking with an LST/LRT built on SSV, users can earn native ETH rewards + SSV tokens from the incentivized mainnet program + restaking points from EigenLayer.

For SSV DAO builders creating these kinds of applications — Claystack, Xhash, P2P, StakeWise (Blockscape early bird vault), to name a few — seamless compatibility also plays a big role in improving the user experience of staking. Not to mention the additional yield provided to their users and possible new revenue streams for themselves.

Are there risks involved? Yes.

So? How can they be mitigated?

SSV as a Standard for Base Layer Resilience

Optimizing for Decentralization & Robustness

Operators are the backbone of these networks — EigenLayer and Ethereum. It’s important that a framework is in place to ensure the safety of a user’s stake and the security of the network from a node operator perspective.

Restaking risks are important to consider. An LRT (which, as we established above, is basically an LSP + restaking) must ensure that node operation is subject to as few risks as possible regarding how the system and infrastructure work. Some of the questions to ask are: How is the protocol handling and storing validator keys? Are they generated securely and who has access?

From an infrastructure perspective. Are they using DVT? How diverse are their clients? Additionally, the protocol’s choice regarding client diversity matters a lot. Naturally, some clients are easier to work with than others, and at times, they are also less resource-intensive. Making one particular client more attractive to use opens the door to less-than-optimal diversification. Decentralization at the base layer is paramount for user and network health.

Guides for Native Restaking on SSV

Detailed guides for distributed native restaking on SSV are available for those interested in leveraging the benefits of SSV’s composable staking infrastructure. The partner examples showcase real-world applications, demonstrating the infrastructure’s versatility and effectiveness.

A Win-Win-Win Situation with SSV Network

At the end of the day, SSV’s re/staking infrastructure offers a win-win-win situation for Ethereum, stakers, and builders. Stakers can choose from 200+ permissionless operators (including many of Ethereum’s finest), developers can join a growing ecosystem (55+), creating the next go-to LRTs, and Ethereum benefits from the decentralization that is inherent in using DVT.

By combining the staking legos, users can optimize their staking strategies, enhance fault tolerance, and contribute to the overall security and decentralization of the network. The Ethereum staking ecosystem has entered a new era, and SSV’s innovative infrastructure is at the foundation.

Website | Builders Hub | Network Hub | Discord | Dev Center | Documentation | GitHub